X8.0 Production Release Notes - Nov 2022

We are delighted to roll out the Version Release Notes for the newest upgrade of Entire OnHire, Version X8.0.

|

|

In these release notes, you'll find the summary of any new features, enhancements, current process changes, and resolved issues in the latest version of the Entire OnHire application. This document allows us to keep you updated with all the latest information about our products and services. Explore the comprehensive X8.0 Version Release Notes with each new feature, current process change, and enhancements explained clearly and concisely with screenshots to showcase the descriptions in action |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 Issues |

|

|

Our product roadmap provides a high-level visual summary that maps out the vision and direction of our product offering over time. Visit our Product Roadmap site to keep updated with our new and exciting offering. |

|

|

November 2022 |

|

|

New Features

Feedback |

|---|---|

New Features

What is STP Phase 2?

The Australian government announced the expansion of the Single Touch Payroll (STP) which includes additional information. This expansion of STP, also known as STP Phase 2, reduces the burden on employers who report employees' information to multiple government agencies. It also helps Services Australia’s customers who may be your employee, get the right payment at the right time.

We all are familiar with the first phase of Single Touch Payroll (STP), an ATO initiative designed to streamline the reporting of employee pay, tax withheld, and superannuation. In STP Phase 2, businesses must report additional information and eliminate existing reporting requirements in certain instances.

Note that the STP processing applies to employers with 19 or fewer employees and is a mandatory obligation. If you are not reporting through STP, businesses should start reporting as penalties may apply.

![]() Visit this link to know more about STP Phase 2 Expansion

Visit this link to know more about STP Phase 2 Expansion

![]() Visit this link to know how to Process Single Touch Payroll in the Finance application

Visit this link to know how to Process Single Touch Payroll in the Finance application

![]() Visit this link to view the STP Phase 2 - Transition Guide

Visit this link to view the STP Phase 2 - Transition Guide

The STP reduces business reporting requirements and enables Australian businesses to digitally engage with Government agencies in a Single Touch Process.

In STP Phase 2, you are required to provide ATO with the additional information however, the way to submit STP has not changed. All Businesses must comply with STP Phase 2 requirements or potentially face penalties from the ATO.

STP Phase 2 is in continuation of STP and remains mandatory. It is advised to all businesses to timely plan the implementation of STP Phase 2. This ensures that compliance deadlines are met and avoids unnecessary penalties.

Important dates to be noted:

The major key changes of the STP Phase 2 are explained below.

1. Gross Formula

The Gross is calculated using distinct new formulas for the Employee and Header files.

Gross for Employee File

The Gross for Employee File is calculated based on the new formula provided below.

STP Phase 2 – Gross Formula for Employee File

Total Shift based Value - Overtime Value + Additions which are set as "Include in Gross Taxable Amount in STP =True" in the Addition and Deduction master + Allowances Value - Allowances which are checked as "Separately Itemise in STP" in the Allowance Master - Allowances checked as "Exclude from Gross Taxable amount in STP" in the Allowance Master - Deductions amount which is as Include in Gross Taxable Amount in STP = “True” in Addition/Deduction master.

Note that the Gross in the STP YTD Report is calculated as per the above formula.

STP Phase 1 – Gross Formula for Employee File

Gross for Header File

Now, the Gross for Header File is calculated based on the new formula provided below.

STP Phase 2 – Gross Formula for Header File

Total Shift based Value + Additions which are set as "Include in Gross Taxable Amount in STP =True" in the Addition and Deduction Master + Additions which are set as Separately Itemise in STP in Addition / Deduction Master + Allowances Value - Allowances checked as "Exclude from Gross Taxable amount in STP" in the Allowance Master - Salary Sacrifice to Superannuation - Salary sacrifice for other employee benefits - Deductions which is as Include in Gross Taxable Amount in STP = True in Addition/Deduction master

Note that the Gross in STP PTD and Gross in STP header file report are calculated as per the above formula.

STP Phase 1 – Gross Formula for Header File

Total Shift based Value + Allowances Value + Additions which are set as "Include in Payment Summary =True" in the Addition and Deduction Master - Allowances which are checked as "Separately Itemise in STP" in the Allowance Master - Allowances checked as "Exclude from Payment Summary" in the Allowance Master - Salary Sacrifice - Deductions which are as include in Payment Summary = “True” in Addition/Deduction Master.

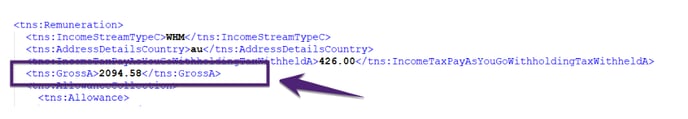

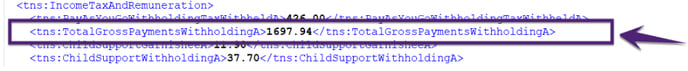

The Gross for Header File Tuple is created for the employer as shown in the figure below.

2. Tax File Number ‘987654321’ is no Longer Valid

The member should not report an invalid Tax File Number (TFN) that will fail to validate while processing the STP run.

In the STP Phase 1, the Tax File Number ‘987654321’ was used for quoting the alphabetic characters as it could not be provided in the TFN field. Now the TFN ‘987654321’should not be reported as this TFN code is no longer valid.

You should request a replacement of the TFN Declaration from the member after confirming that the original is not valid. While awaiting updated information, you can report the member’s income using the following exemption codes:

-

111 111 111 – within 28 days since the request for the TFN Declaration was performed or

-

000 000 000 – more than 28 days since the request for the TFN Declaration was performed

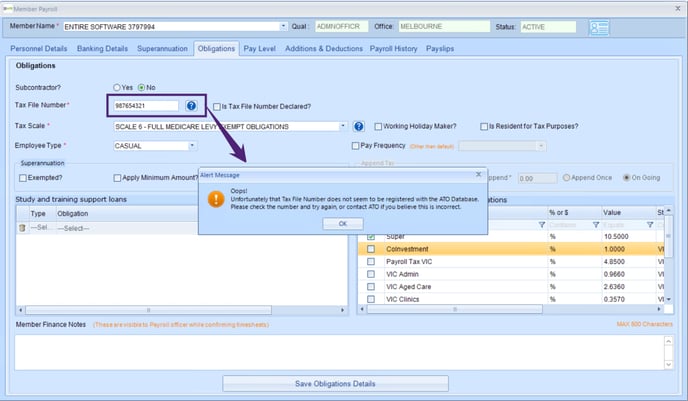

In the STP Phase 2 enabled application, staff will not be able to save the TFN ‘987654321’ in the Member module once the STP Phase 2 is rolled out and will show the alert message as shown in the figure below.

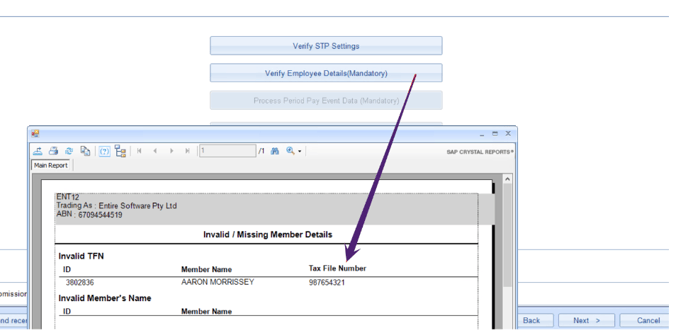

Also, the system will validate the TFNs during STP processing by clicking Verify Employee Details (Mandatory). In case any member has TFN ‘987654321’, the member details will appear in the list of Invalid TFNs.

How to Generate Existing Members List with TFN ‘987654321’?

In the Staff portal application, to generate the list of the existing members having TFN ‘987654321’:

-

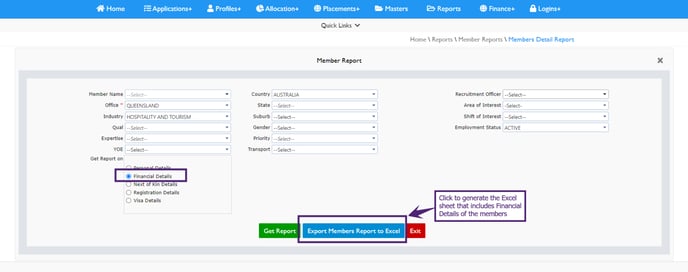

Click Reports

→Member Reports→Member Detail Report and the Member Report opens -

Select the filter option as the Financial Details option and click Export Members Report to Excel and the Members Detail Report is downloaded

-

Open the CSV file to fetch the list of members by filtering TFN ‘987654321’

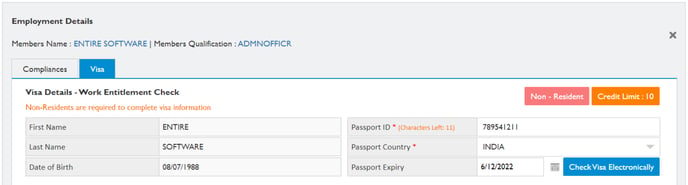

3. Visa Country of Existing Working Holiday Makers

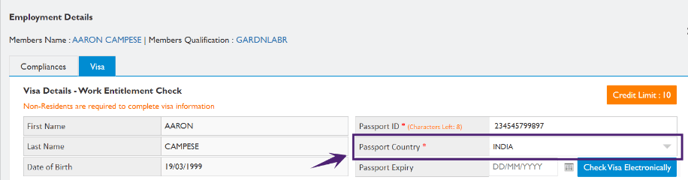

You need to mandatorily report the visa country for the employees who report to tax jurisdictions outside of Australia. This is relevant for businesses with staff having specific visas (i.e., Australian residents working overseas or Working Holiday Makers).

It is mandatory to provide the visa country for each Workers Holiday Maker so that when the STP Phase 2 reporting is enabled, users will be able to update this information immediately without any impact on STP reporting.

In the Staff portal application, the Passport Country is the mandatory field in the Visa tab for the member in the Employment Details page as shown in the figure below.

4. Review/Update all Allowances/Additions Settings in the Masters as per ATO Guidelines along with their Remapped Codes

In STP Phase 2, all the Allowances and Additions are itemised separately, not just expense allowances that may have been deductible on the employee’s IITR. This means that allowances and additions that used to be reported as Gross for the income type must now be separately itemised in STP Phase 2 reporting.

Also, STP Phase 2 introduces the ability to report the deductions for Child Support Garnishee/Child Support Deduction and eliminates the need for employers to provide separate remittance advice to the Child Support Registrar while reporting through STP. However, you need to pay the required amounts directly to ATO by the date specified in your notice.

Click to view the details to review/update all the allowances and additions:

While transitioning from STP Phase 1 to STP Phase 2, the Entire OnHire team will update the master settings of all the allowances and additions to be selected as ‘Separately Itemise in STP’, except reimbursements (if any provided by you), as per the prerequisites document after STP Phase 2 rollout.

While transitioning from STP Phase 1 to STP Phase 2, all the existing Allowances and Additions codes will be remapped by the Entire OnHire team with the new codes defined as per ATO guidelines based on the data shared by you in the prerequisites document.

You need to review the remapped Allowances and Additions codes after the STP Phase 2 rollout and ensure that the codes are set as per your requirement for a successful STP run.

5. Change in Workers Holiday Maker Scale

As per the ATO obligation, the clients must be registered as an employer of Working Holiday Maker in case of employment or planning to employ workers who hold either:

-

Working Holiday visa (subclass 417) or

-

Work and Holiday visa (subclass 462)

The new Workers Holiday Maker Tax Scales are introduced in STP Phase 2. The two new tax scales added are the Workers Holiday Maker Scale - Unregistered Employer, and Workers Holiday Maker Scale - No TFN Supplied.

Employers must be registered as Workers Holiday Maker before making the first payment to the employees. In case the employer is not a registered Workers Holiday Maker, the employer will have to deduct higher tax rates for the employees.

While transitioning from STP Phase 1 to STP Phase 2, the Entire OnHire team will be updating your Employer Worker Holiday Maker Registration Status settings as per the information provided by you. In case the status is not provided in the prerequisites document by you, the system will be set to ‘Registered Employer for Workers Holiday Maker’ after the STP Phase 2 rollout.

In case, you are not registered as an employer of Working Holiday Makers, the Entire OnHire team will update your Workers Holiday Maker employees tax scale to Workers Holiday Maker Scale - Unregistered Employer after STP Phase 2 rollout. This will be set in case you have selected the option as ‘YES’ for the ‘Do you want us to update your Workers Holiday Maker employees tax scale to Workers Holiday Maker Scale - Unregistered Employer’ in the prerequisites document.

To view detailed information about each Workers Holiday Maker Tax Scale, click the respective links below:

6. Validations to Restrict User to Change the Tax Scale from Workers Holiday Maker Scale to Australian Resident Scale and Vice versa

-

As per the ATO guidelines for STP Phase 2, the staff is restricted to update any Workers Holiday Maker Tax Scale, once the payrun for the member has been performed on the Australian Resident Tax Scale.

In the Finance application, when the staff changes the Tax Scale of the member to any Workers Holiday Maker Tax Scale from the selected Australian Resident Scale and the payrun of the member is already performed in the selected branch (with the Australian Resident Scale), the staff will get a validation pop-up on clicking the save button as shown in the figure below and staff will not be able to change the Tax Scale.

Similarly, in the Staff portal application, the staff is restricted to update any Workers Holiday Maker Tax Scale, once the payrun for the member has been performed on the Australian Resident Tax Scale.

-

As per the ATO guidelines for STP Phase 2, the staff is restricted to update any Australian Resident Tax Scale once the payrun for the member has been performed on the Workers Holiday Maker Tax Scale.

In the Finance application, when the staff changes the Tax Scale of the member to any Australian Resident Scale from the selected Workers Holiday Maker Scale and the payrun of the member is already performed in the selected branch (with the Workers Holiday Maker Scale), the staff will get a validation pop-up on clicking the save button as shown in the figure below and staff will not be able to change the Tax Scale. Similarly, in the Staff portal application, the staff is restricted to update any Australian Resident Tax Scale once the payrun for the member has been performed on the Workers Holiday Maker Tax Scale.

Similarly, in the Staff portal application, the staff is restricted to update any Australian Resident Tax Scale once the payrun for the member has been performed on the Workers Holiday Maker Tax Scale.

7. Payment Date by Entity

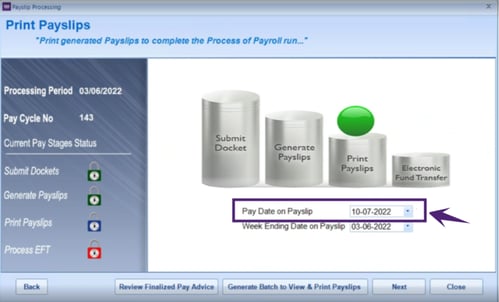

You should ensure to submit the STP run on or before the Payment Date. The Payment Date is the date when the payslip is processed. While processing the STP run, validations are in place for the Payment Date by Entity.

The Payment Date Header Tuple is created as shown in the figure below.

In the Finance Application, this Payment Date is picked from the selected Pay Date on Payslip in the Payslip Processing screen as shown in the figure below.

![]() Click this link to view the detailed STP Phase 2 expansion document.

Click this link to view the detailed STP Phase 2 expansion document.

![]() Click this link to view the STP Phase 2 Transition Guide

Click this link to view the STP Phase 2 Transition Guide ![]() .

.

Import Shifts

The Import Shifts feature facilitates users to create customized shift import templates, configure these templates, import files, and access shift import logs. Following the simple steps, you can easily import shifts into our Entire OnHire application as per your requirements ![]() .

.

The Import Shifts allow the user to configure each template that is linked with the Service Location and can be configured based on Employee ID Mapping, Default Values, and Unique Parameter. The Import Shifts template configuration is a one-time process and you can also create the global Import Shifts templates. The Shift Templates configuring involves:

-

Employee ID Mapping – Upload the Employee File with the Client Employee ID filled against the Entire OnHire Employee ID and the system automatically maps the data

-

Default Values – This configuration allows the user to set default values/ format and is mandatory for Import Shifts

-

Unique Parameter – Based on the selected parameters/ priority, the uniqueness of the shift (uploaded from the Excel file) is decided

The main Import Shifts functionality occurs in the Import File page and is used by the users whenever the Shifts need to be imported based on the Import Shifts data. The Import Shifts data for the selected templates is performed either “For an Unmanaged Job” or “As shifts without an existing job”.

You can view the Shifts Import Logs that show the status of the event ![]() .

.

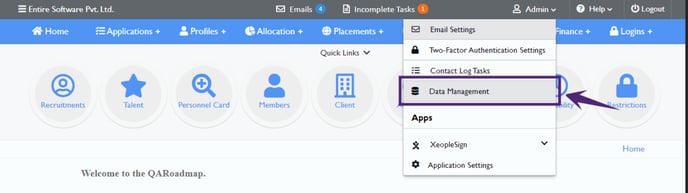

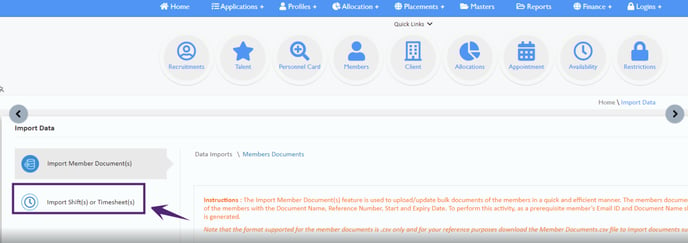

How to Access Import Shifts?

To access Import Shifts:

-

Click Data Management from the user login drop-down of the Entire OnHire application

-

The Import Data page opens, now click Import Shift(s) or Timesheet(s) to open the Import Shifts page

-

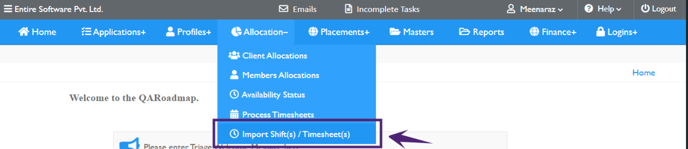

Or you can also access Import Shifts from Allocation → Import Shifts(s) / Timesheet(s)

Shift Import Template

On clicking the Import Shift(s) or Timesheet(s), the Shift Import Template page opens. The Shift Import Template page displays all the existing templates and forms a repository of all the available Shift Import Templates.

This page shows the Template Name, Service Location, Delivery Location, Last Updated On, Last Updated By, Status, and Action details of all the existing templates. You can:

-

Edit/ delete the existing Shift Import Template by clicking the Edit or Delete Actions icons respectively

-

Directly view the shift import logs, by clicking the View Logs icon

-

Active/ Inactive the existing Shift Import Template by clicking the Status toggle button

-

Create a new Shift Import Template by clicking the Add Template button

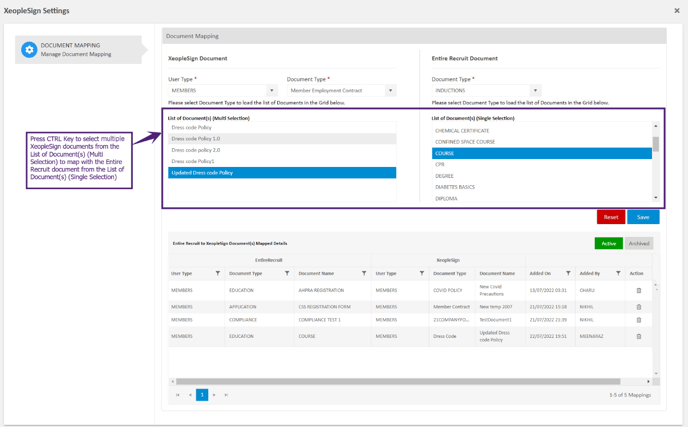

XeopleSign Phase 2

The XeopleSign Phase 2 is the enhanced version of the XeopleSign Phase 1. The major enhancements in this version include Document Mapping, XeopleSign Authorisation, the addition of a new User Type as a Professional, and share documents with professionals.

Document Mapping facilitates to map the XeopleSign documents with the Entire OnHire documents. The XeopleSign Authorisation helps to setup access to the XeopleSign Dashboard for the Authorised Users.

Click the link to visit the XeopleSign Phase 1 document ![]() XeopleSign - Phase 1.

XeopleSign - Phase 1.

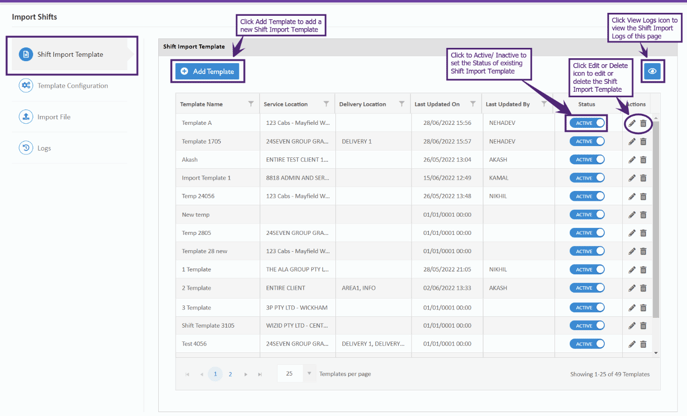

XeopleSign Authorization

Access to the XeopleSign Dashboard is managed by the Job Boards Master of the Entire OnHire application. You need to setup the XeopleSign Job board with the correct API details and add authorised users to the XeopleSign Job Boards Master.

XeopleSign Job Board

To access the XeopleSign Dashboard, the XeopleSign Job Board should exist in the Job Boards Master as shown in the figure below. The XeopleSign Job Board detail includes the Job Board Name, Job Board Description, API Key, API Secret Key, Entire API, and Status.

The access to the XeopleSign Dashboard is authenticated by providing the valid API Key and API Secret Key.

XeopleSign Authorised User

The Staff needs to add authorised users to access the XeopleSign Dashboard in the Entire OnHire application. The new authorised user details include:

- Internal Staff name - User Profile

- Job Board User Name - Type in name to match your user profile

- Job Board User Id - Your Email Id

- Job Board User Password - Your Password

- Status - Active

To access XeopleSign Dashboard, the Status of the authorised user should be Active.

Document Mapping

Document Mapping is a tool that facilitates to map the XeopleSign documents with the Entire OnHire documents. The mapped Entire OnHire documents are displayed as the Member documents on the Document page/ Training Details page/ Health Details page.

Bulk Sharing with Professional

To share the documents with the Professionals for e-signing, select the required Professionals from the Search Professional page and click the XeopleSign logo as shown in the figure below.

You should have a valid Email ID for the professional before sharing the document.

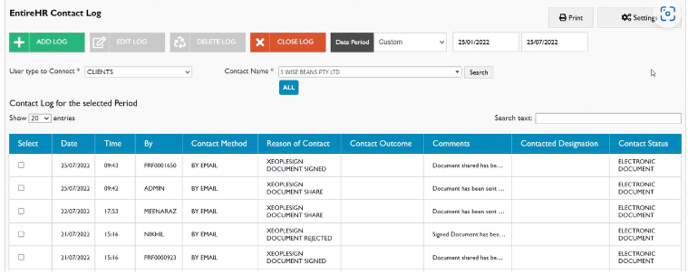

Contact Log

When the XeopleSign documents are sent for e-signing to a Professional from the Staff Portal or XeopleSign application, the logs are created in the Contact Log against its Clients. If the professional is linked with multiple clients, the document logs are created against all the Clients to which the professional is linked.

![]() For a detailed XeopleSign Phase 2 document, refer to this link.

For a detailed XeopleSign Phase 2 document, refer to this link.

Enhancements

Finance Application

Shift Allowances for Unmanaged Job in Import Shifts

This functionality applies to the shifts of Unmanaged Jobs while using the Import Shifts utility. When the shifts of Unmanaged Jobs are imported against a Job into the Entire OnHire system using the Import Shifts utility, in case the Job contains the Shift Allowances, the Finance application:

-

Shows the provided Shift Allowances uploaded in the Confirm Shift screen against the shift. All the provided Shift Allowances of the shift against a job are always uploaded and reflected in this screen

-

If the Shift Allowance is Shift Type – it is applied once to the shift irrespective of split shift (manual/ through award)

-

If the Shift Allowance is Hour Type – it is applied to all split parts of the Shift (manual/ through award)

-

-

The rates for the Shift Allowance are fetched from the rates table (if exists for the provided allowance based on shift parameters)

-

In case Overtime is applied, the Shift Allowances of the shift for an Unmanaged Job remain the same however, the allowances from overtime are included

-

In case the shift type or any other details are modified that need to fetch new allowances, a confirmation pop-up message appears to fetch new allowances in the Confirm screen. Click Yes and the system applies for new allowances along with unmanaged job shift allowance

Note that for the Shift Allowance, even if the allowance is set to “Exclude as default allowance” in the Pay and Invoice Allowances screen:

-

Allowance manually added for a shift in the Confirm Shift screen picks rates from the rate table automatically

-

Allowances added against the job for whom shifts are imported through the Import Shifts utility are visible on the Confirm Shift screen by default and their rates are always fetched from the rate table

Default Allowances

The Default Allowances are now shown based on the “Exclude as Default Allowance” checkbox field as shown in the figure below.

-

If the “Exclude as Default Allowance” field is unchecked - the system fetches the default allowances for pay and invoice as per the existing process in the Confirm Shift

-

If the “Exclude as Default Allowance” field is checked - the system will not fetch the default allowances for pay and invoice in the Confirm Shift. This is applicable on the overtime conditions or at the time of changing the shift type or any other value

When you mouse hover on the “Exclude as Default Allowance” an information tool tip is displayed.

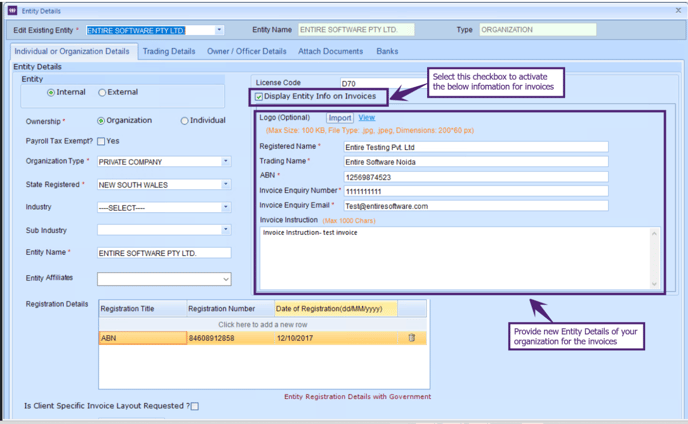

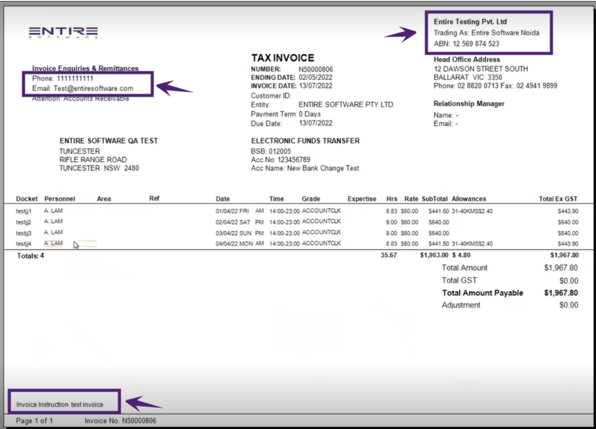

Entity Details

You can now print different Entity Details on your invoices than provided in your Software Registration Details screen.

In the Entity Details screen, set the new Entity Details of your organization for the invoices. To set the new Entity Details for the Existing Entity:

-

Select Logo by clicking the Import button. Providing the logo is optional

The logo image should have file type as .jpg or .jpeg with max. size 100 KB and dimensions around 200*60 px.

-

Provide Registered Name of Organization

-

Provide Trading Name

-

Provide ABN

-

Provide Invoice Enquiry Number and Invoice Enquiry Email

-

Provide Invoice Instruction (with 1000 characters maximum limit)

Once all the details of the Entity are set:

-

Select the Display Entity Info on Invoices checkbox. When this checkbox is selected, the system prints all the provided details of this section in your invoices for the client mapped with the entity

Note that on selecting the Display Entity Info on Invoices checkbox, the details are applicable to Invoice Consolidated File, Invoice Preview, Individual Invoices, Invoice Docket Collation, Invoice Reprint, Invoice Credit/ Debit Notes, all invoice formats, and invoices generated from web feature.

The figure below shows the new Entity Details of the organization for the invoices provided in the Entity Details screen.

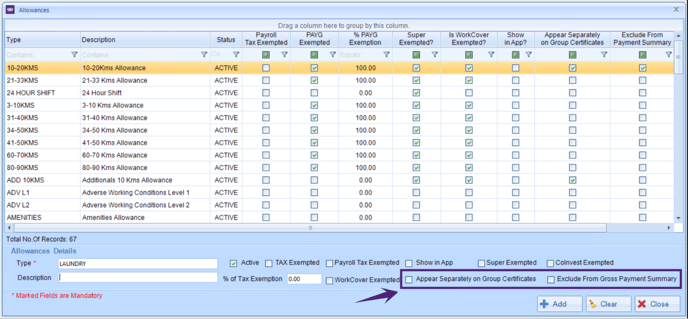

Allowances

In the Allowances screen, you can select either Appear Separately on Group Certificates or Exclude From Gross Payment Summary in the Allowances Details. Note that the STP Gross formula for the Employee File of STP Phase 2 deducts any one of the specified allowances at a time.

Member App

Casual Availability Screen Improvements

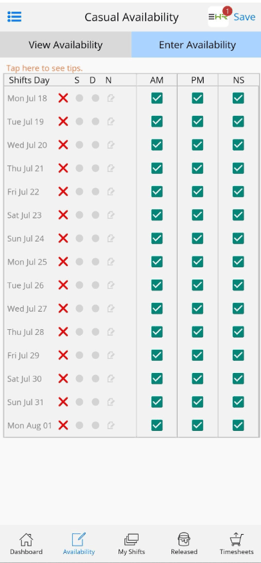

In the Casual Availability screen, now the Shifts Day count in the Enter Availability screen displays the data dynamically.

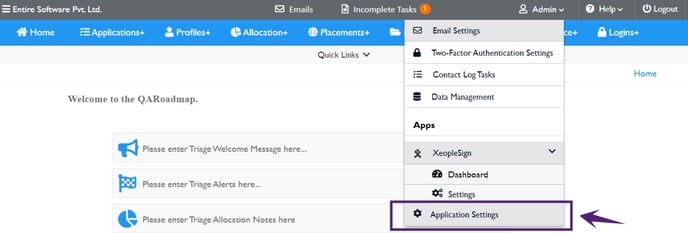

To set the Shifts Day availability for the Member App, in the Staff Portal application:

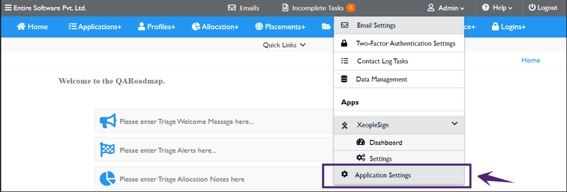

-

Click the user login drop-down in the Entire OnHire application and open the Application Settings

-

In the Application Settings, click System Configurations

-

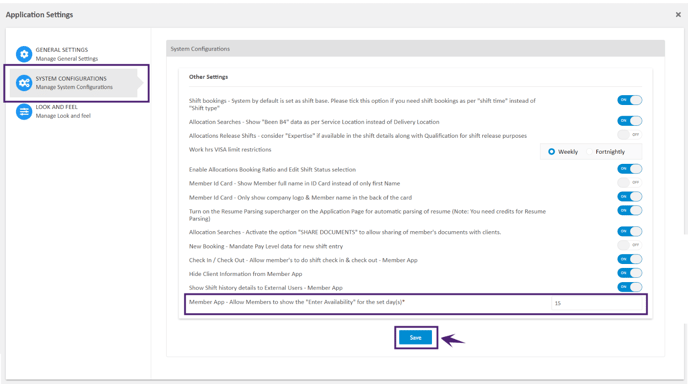

Now, in the Other Settings provide the number of days in ‘Member App - Allow Members to show the “Enter Availability” for the set day(s)’ to set the Shifts Day view for the members in Member App

The Enter Availability Days should range between 1 to 30.

For instance, if the ‘Member App - Allow Members to show the “Enter Availability” for the set day(s)’ is set to 15 days in the Staff portal application.

In the Casual Availability screen, now the Shifts Day reflected are 15 days only in the Enter Availability as shown in the figure below.

Released/ Assigned Shifts Improvements

When the Client Compliance flag is set as ON and the Gastro Restrictions are applicable on the shift, while accepting the shift, now the member will be able to accept the shift without viewing the compliance rules.

-

This is reflected in the Released Shifts screen while the member accepts the shift as shown in the figure below

- This is reflected in the Assigned Shift screen while the member accepts the shift as shown in the figure below

Shift and Job Timesheet Improvements

Shift Timesheet

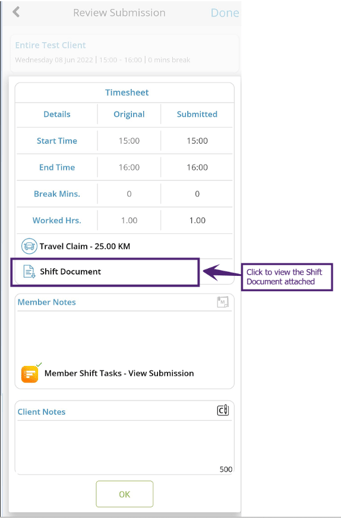

For the Shift Timesheet, the Review Submission screen now shows the Travel Claims and Shifts Documents details to the Client/ Supervisor when the flag is set as ON respectively.

When the Travel Claim flag is set as ON for the member – The Travel Claim is visible on the Review Submission screen for the Client/ Supervisor, whenever the member adds travel claim details as shown in the figure below.

When the Shift Document flag is set as ON for the member – The Shift Document attached by the member is visible on the Review Submission screen for the Client/ Supervisor, whenever the member adds documents.

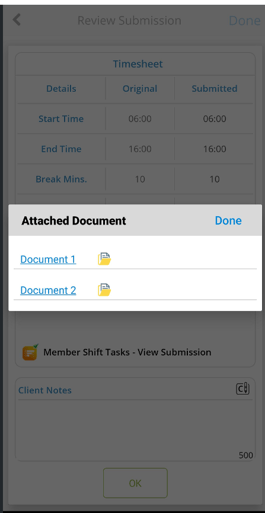

Click Shift Document to view the Attached Document as shown in the figure below.

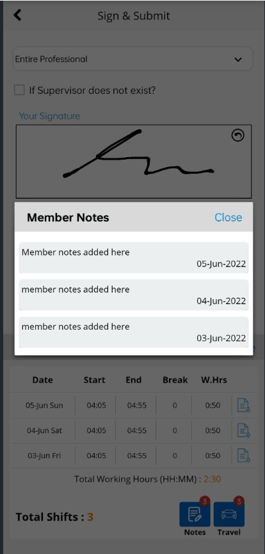

Job Timesheet

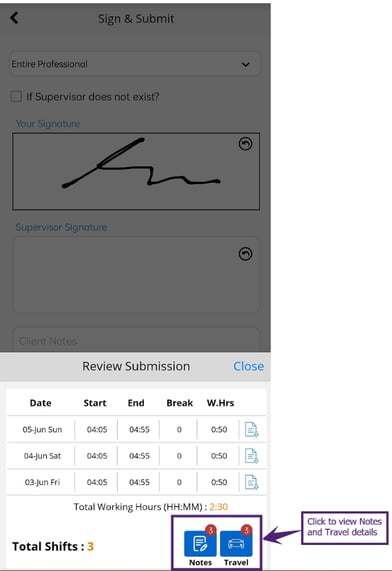

When the Client reviews the Job Timesheet, the Review Submission screen shows the Travel and Notes details to the Client/ Supervisor when the flag is set as ON respectively.

In the Review Submission screen, the timesheet details show the Date, Start time, End time, Break mins., and Total Working Hours. The Travel and Notes icons show the number of Travel Claims and Notes added.

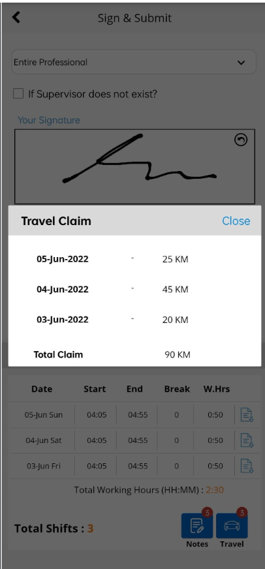

For the Job Timesheet, when the Travel Claim flag is set to ON for the member – The Travel icon is visible on the Review Submission screen for the Client/ Supervisor, whenever the member adds travel claim details.

Click the Travel icon, to view the Travel Claim details.

For the Job Timesheet, when the Notes flag is set to ON for the member – The Notes attached by the member are visible on the Review Submission screen for the Client/ Supervisor, whenever the member adds Notes.

Click the Notes icon, to view the provided Notes.

Note that for the Job/ Shift Timesheet, if the Travel and/ or Documents are provided by the member and the Flag is set as ON, only in that scenario, the details are visible to the Client/ Supervisor for review.

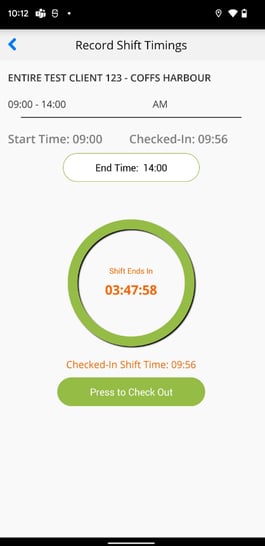

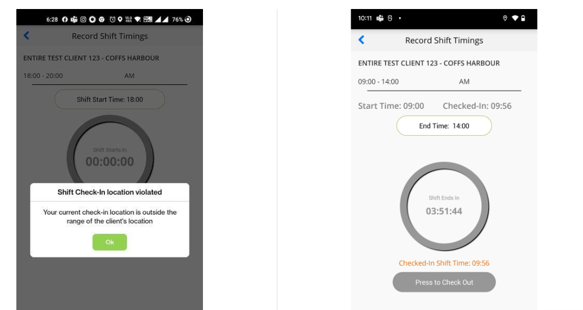

Member Distance Restriction for Check-In / Check-Out

The Member App can restrict members to Check-In / Check-Out the Shift within the provided Member's Check-In / Check-Out distance restriction parameter. This parameter is set in the Application Settings of the Entire OnHire Staff Portal application.

To activate this feature, please call the support team to set up your account with google maps.

To set the Member distance restriction parameter to Check-In / Check-Out for the members in the Staff Portal application:

- Click the user login drop-down in the Entire OnHire application and open the Application Settings

-

In the Application Settings, click System Configurations

-

Now, in the Other Settings provide the value greater than 0.0 KM in ‘Member Check-In / Check-Out distance restriction: Apply distance in KMS restriction as per Client location address’ to set the distance restriction for the members in the Member App

-

You can set the ‘Member Check-In / Check-Out distance restriction’ parameter between 0.01 KM to 1.0 KM

This setting is enabled only in case the ‘Enable shift check-in/check-out in Member App’ flag is set to ON.

In the Record Shift Timings screen of the Member App, the member can Check-In / Check-Out within the provided range in the Application Settings of the Staff Portal application. The Member Check-In / Check-Out distance restriction range set can be greater than 0.0 KM up to 1.0 KM of the client location.

The value 0.0 KM means no restriction in the Check-In / Check-Out to Record Shift Timings.

For instance, if the ‘Member Check-In / Check-Out distance restriction: Apply distance in KMS restriction as per Client location address’ parameter is set to 1.0 KM in the Application Settings of the Staff portal application. The Record Shift Timings screen allows members to Check-In / Check-Out to record the Shift Timings within the range of 1.0 KM of the Client’s Location as shown in the figure below.

In case the member tries to Check-In / Check-Out outside this client’s location range, a Shift Check-in / Check-out location violated alert message is generated as ‘Your current check-in / check-out location is outside the range of the client’s location' as shown in the figure below.

The member can Check-In / Check-Out successfully only when the member is within the distance restriction parameter provided of the client’s location.

Employment Details – Passport Country for Visa

In the Employment Details page of the member, the Passport Country in the Visa tab is now shown as a drop-down selection. In Passport Country, the user needs to select the required country from the drop-down that is sorted in alphabetical order ![]() .

.

Note that the Passport Country in the drop-down is fetched from the Main Master - Country & State.

If the provided Passport Country does not exist in the Passport Country drop-down, an alert message icon is displayed. Hover on the alert icon and the message is displayed ‘Last country entered was "<name of the country>" . This is invalid country name . Please select Country from the dropdown'.

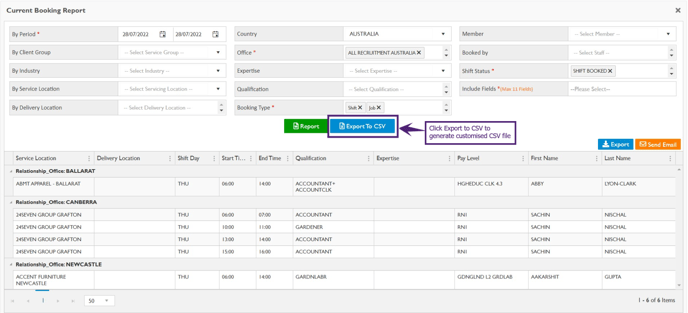

Current Booking Report Improvements

In the Current Booking Report, new fields are added that allow the user to search bookings for Jobs and Shifts. The details of new fields added in the Current Booking Report are:

-

Booking Type: a user can search booking report for Job, Shift, or Both (i.e. Job and Shift), and by default Shift is selected in the Booking Type

-

When the Booking Type selected is Job, all the jobs are shown in the booking report including other selected parameters

-

When the Booking Type selected is Shift, all the shifts and shift rosters of the job are shown in the booking report including other selected parameters

-

When the Booking Type selected is Both, all the shifts and jobs are shown in the booking report including other selected parameters

-

-

Include Fields: apart from the existing fields, a few more fields are added that include Job ID, Reference Number, Allowance Name, and Booking Type

-

Job ID: shows the Job ID against the shift or roster generated in the report

-

Reference Number: shows the reference number of the job

-

Allowance Name: shows the allowance names mentioned for the shifts

-

Booking Type: the booking type can either be shift or job

-

Note that the Shift Date, Start, and End fields are renamed to Start Date, Start Time, and End Time respectively.

Click Report to generate the report for the selected data. To export the generated data into CSV, click Export to CSV. In the downloaded CSV file, new fields data is reflected for Reference Number, Booking Type, Job ID, and Allowances Name and are appended at the end of the CSV file.

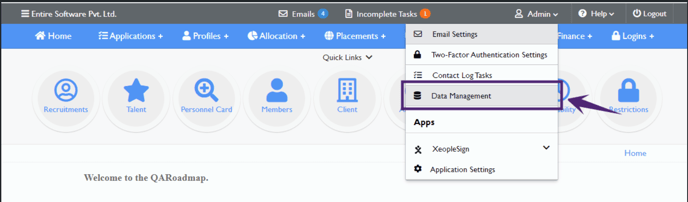

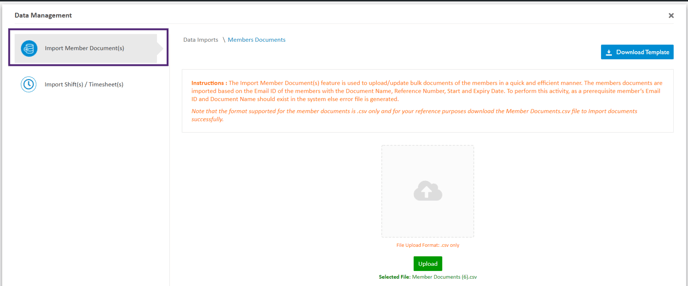

Access to Import Data - Modified

Access to the Import data has changed in the Entire OnHire application. To access Import Data:

-

Click Data Management from the user login drop-down of the Entire OnHire application

-

The Data Management opens the Import Member Document(s) page

Note that the functionality of Import Data is not modified, refer to the detailed Import Data document by clicking the link here. ![]()

Automated Non-Compliance

On the Personnel Card of the applicant, the default value of the Non-Compliant is shown as ‘Yes’ for the sections that has Must Comply set as ‘Yes’, when the applicant is created.

This applicant will appear in the Non-Compliant section as ‘Yes’ unless the user manually edits the value to ‘No’ in the Personnel Card for all the sections.

This change will not be effective for any of the previous non-compliance details of the applicant.

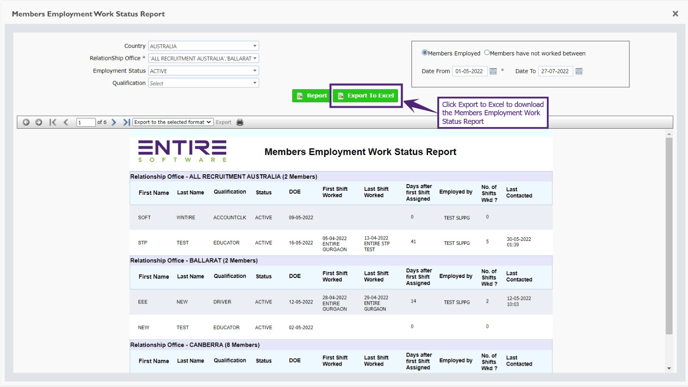

Members Employment Work Status Report Improvements

Now, you can export the data of the Members Employment Work Status Report into the Excel sheet. To export the data into the Excel sheet:

-

Click Reports → Recruitment Reports → Members Employment Work Status Report

-

Select all the required details and click Report

-

To export this report, click Export to Excel and the data is exported into the Excel sheet

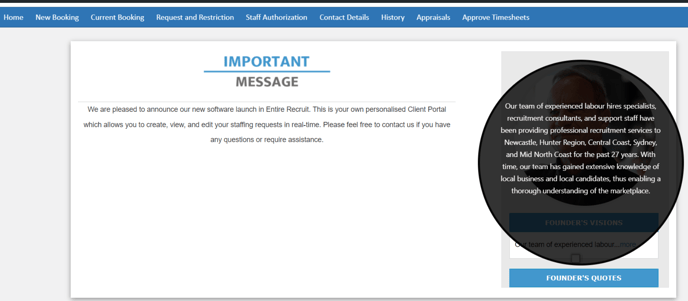

Client/ Professional Portal Messages

You can now customise the Portal Messages for Client/ Professional portals. To modify the Portal Messages:

-

Click Masters → Main Masters → Portal Messages

-

Click expand icon of the ‘CLTWEBHOME’ Message Group Keyword

-

Now, click the edit icon to update the Keyword Description and Message for the Vision and Quotes

- Once the Keyword Description and Message are updated, it gets reflected in the Client/ Professional Portal

- Click Keyword Description to view the provided Message, for instance in the figure below on clicking the FOUNDER’S VISION, provided Message is displayed

Resolved Issues

We are constantly working to improve our Entire OnHire Application and have resolved all these issues for you ![]() .

.

|

Issues |

Summary |

Status |

|

When a Shift is locked by the Staff in the Finance portal, validation messages should be shown in the Client/ Professional Portals accordingly. |

Issue Amended. When the Shift(s) are locked in the Finance Application, the professional will not be able to approve the timesheets in the Client/ Professional portal. In the Client/ Professional portal while approving the timesheet, the validation message appears on clicking the ‘Docket Number’ or ‘Pending for Client Review’ hyperlink or ‘Approve Multiple Timesheets’ as “You cannot process this shift as shift is locked in the Finance portal”. |

RESOLVED ✅ |

|

Reports: Send Email not delivering the email to the customized Email ID. |

Issue Amended. In the Professional → Search Professional, while Sending Email now you can provide the customized Email Id and the mail will be delivered successfully. |

RESOLVED ✅ |

|

In the Applicant portal, if the BSB is not listed, the applicant is not able to save his bank details and gets error. |

Issue Amended. In the Applicant Portal → Finance, the applicant can now add the BSB details in the Banking Details by selecting “If your Bank BSB is not listed above then please check the box to enter your Bank Details” checkbox, if the BSB is not already listed. |

RESOLVED ✅ |

|

While Reviewing Timesheet, the formatting is not retained in the ‘By Client’ field for the disputed shift, when closing the Review Timesheet pop-up. |

Issue Amended. When the Client/ Supervisor Reviews Timesheets, now while disputing the shift the formatting is retained in the ‘By Client’ field on closing the Review Timesheet pop-up. |

RESOLVED ✅ |

|

While submitting the timesheet, the attached timesheet image is missing. |

Issue Amended. Now, the timesheet submission email notification is sent along with the attached timesheet image successfully, when the member submits the timesheet to the Staff. This is applicable for Single/ Multiple Timesheet submission for both Shifts and Jobs. |

RESOLVED ✅ |

|

Error message generated when adding a new delivery location in the Client Details page. |

Issue Amended. In the Client Details page, user can now Add Delivery location below the parent client successfully. |

RESOLVED ✅ |

|

Calendar Format in the Entire OnHire Application should be from Monday to Sunday (Mon to Sun). |

Issue Amended. Now, in the Entire OnHire application, the Calendar Format followed is from Monday to Sunday. |

RESOLVED ✅ |

|

Issue in adding the Client details for a new Client. |

Issue Amended. Now, in the View Login Details, the limit of client Login Password is increased and the new client details are added successfully for the client. |

RESOLVED ✅ |

|

Edit Shift details not allowed with the Status as Timesheet Submitted in the Allocations screen. |

Issue Amended. In the Allocations screen of the Staff portal application, user will not be allowed to Edit Shift details with the Shift Status as Timesheet Submitted except the Order No. |

RESOLVED ✅ |

Feedback

We have incorporated the new features, enhancements, and fixes to provide you with a delightful user experience ![]() . We would love to hear back from you about your experience with our product or service. Please drop your suggestions and feedback at

. We would love to hear back from you about your experience with our product or service. Please drop your suggestions and feedback at ![]() support@xeople.com.

support@xeople.com.