Single Touch Payroll (STP) - Phase 2

Content

What is STP Phase 2?

What is the Impact?

What are the Key Changes?

Help Alerts for STP Phase 2

Enforced STP with Validation Messages

Validation to Generate Valid Data Files

Pay Event Header File

Pay Event Employee File

What is STP Phase 2?

The Australian government announced the expansion of the Single Touch Payroll (STP) which includes additional information. This expansion of STP, also known as STP Phase 2, reduces the burden on employers who report employees' information to multiple government agencies. It also helps Services Australia’s customers who may be your employee, get the right payment at the right time.

We all are familiar with the first phase of Single Touch Payroll (STP), an ATO initiative designed to streamline the reporting of employee pay, tax withheld, and superannuation. In STP Phase 2, businesses must report additional information and eliminate existing reporting requirements in certain instances.

Note that the STP processing applies to employers with 19 or fewer employees and is a mandatory obligation. If you are not reporting through STP, businesses should start reporting as penalties may apply.

![]() Visit this link to know more about STP Phase 2 Expansion

Visit this link to know more about STP Phase 2 Expansion

![]() Visit this link to know how to Process Single Touch Payroll in the Finance application

Visit this link to know how to Process Single Touch Payroll in the Finance application

![]() Visit this link to view the STP Phase 2 - Transition Guide

Visit this link to view the STP Phase 2 - Transition Guide

The STP reduces business reporting requirements and enables Australian businesses to digitally engage with Government agencies in a Single Touch Process.

In STP Phase 2, you are required to provide ATO with the additional information however, the way to submit STP has not changed. All Businesses must comply with STP Phase 2 requirements or potentially face penalties from the ATO.

STP Phase 2 is in continuation of STP and remains mandatory. It is advised to all businesses to timely plan the implementation of STP Phase 2. This ensures that compliance deadlines are met and avoids unnecessary penalties.

Important dates to be noted:

The major key changes of the STP Phase 2 are explained below.

1. Gross Formula

The Gross is calculated using distinct new formulas for the Employee and Header files.

Gross for Employee File

The Gross for Employee File is calculated based on the new formula provided below.

STP Phase 2 – Gross Formula for Employee File

Total Shift based Value - Overtime Value + Additions which are set as "Include in Gross Taxable Amount in STP =True" in the Addition and Deduction master + Allowances Value - Allowances which are checked as "Separately Itemise in STP" in the Allowance Master - Allowances checked as "Exclude from Gross Taxable amount in STP" in the Allowance Master - Deductions amount which is as Include in Gross Taxable Amount in STP = “True” in Addition/Deduction master.

Note that the Gross in the STP YTD Report is calculated as per the above formula.

STP Phase 1 – Gross Formula for Employee File

Gross for Header File

Now, the Gross for Header File is calculated based on the new formula provided below.

STP Phase 2 – Gross Formula for Header File

Total Shift based Value + Additions which are set as "Include in Gross Taxable Amount in STP =True" in the Addition and Deduction Master + Additions which are set as Separately Itemise in STP in Addition / Deduction Master + Allowances Value - Allowances checked as "Exclude from Gross Taxable amount in STP" in the Allowance Master - Salary Sacrifice to Superannuation - Salary sacrifice for other employee benefits - Deductions which is as Include in Gross Taxable Amount in STP = True in Addition/Deduction master

Note that the Gross in STP PTD and Gross in STP header file report are calculated as per the above formula.

STP Phase 1 – Gross Formula for Header File

Total Shift based Value + Allowances Value + Additions which are set as "Include in Payment Summary =True" in the Addition and Deduction Master - Allowances which are checked as "Separately Itemise in STP" in the Allowance Master - Allowances checked as "Exclude from Payment Summary" in the Allowance Master - Salary Sacrifice - Deductions which are as include in Payment Summary = “True” in Addition/Deduction Master.

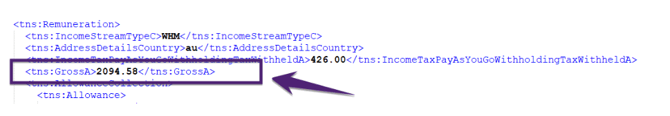

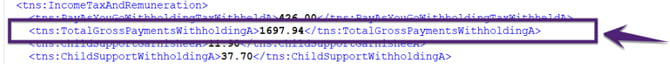

The Gross for Header File Tuple is created for the employer as shown in the figure below.

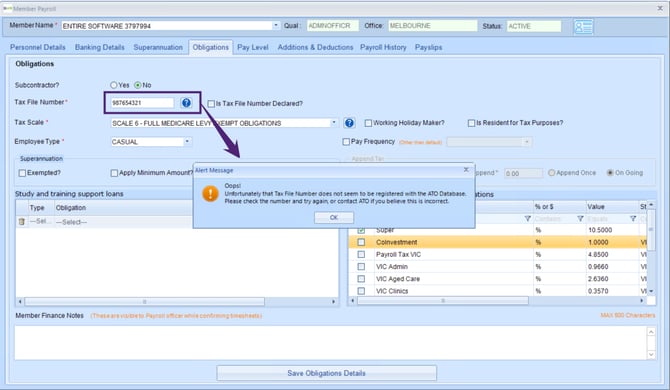

2. Tax File Number ‘987654321’ is no Longer Valid

The member should not report an invalid Tax File Number (TFN) that will fail to validate while processing the STP run.

In the STP Phase 1, the Tax File Number ‘987654321’ was used for quoting the alphabetic characters as it could not be provided in the TFN field. Now the TFN ‘987654321’should not be reported as this TFN code is no longer valid.

You should request a replacement of the TFN Declaration from the member after confirming that the original is not valid. While awaiting updated information, you can report the member’s income using the following exemption codes:

-

111 111 111 – within 28 days since the request for the TFN Declaration was performed or

-

000 000 000 – more than 28 days since the request for the TFN Declaration was performed

In the STP Phase 2 enabled application, staff will not be able to save the TFN ‘987654321’ in the Member module once the STP Phase 2 is rolled out and will show the alert message as shown in the figure below.

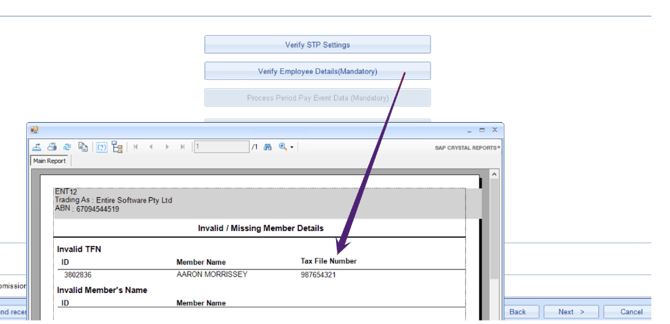

Also, the system will validate the TFNs during STP processing by clicking Verify Employee Details (Mandatory). In case any member has TFN ‘987654321’, the member details will appear in the list of Invalid TFNs.

How to Generate Existing Members List with TFN ‘987654321’?

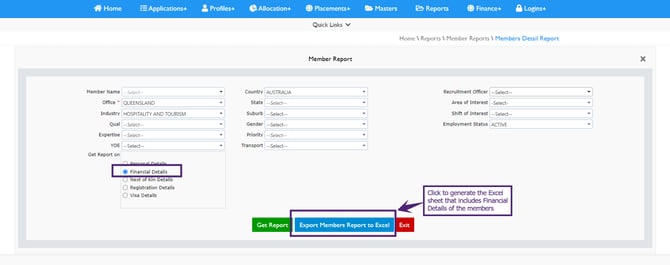

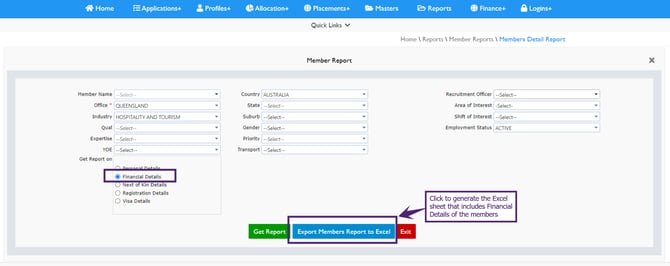

In the Staff portal application, to generate the list of the existing members having TFN ‘987654321’:

-

Click Reports

→Member Reports→Member Detail Report and the Member Report opens -

Select the filter option as the Financial Details option and click Export Members Report to Excel and the Members Detail Report is downloaded

-

Open the CSV file to fetch the list of members by filtering TFN ‘987654321’

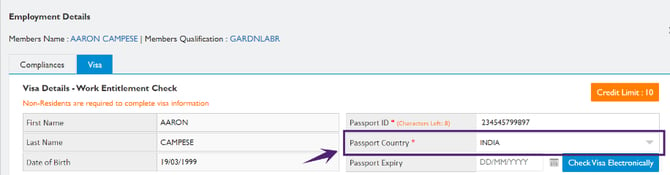

3. Visa Country of Existing Working Holiday Makers

You need to mandatorily report the visa country for the employees who report to tax jurisdictions outside of Australia. This is relevant for businesses with staff having specific visas (i.e., Australian residents working overseas or Working Holiday Makers).

It is mandatory to provide the visa country for each Workers Holiday Maker so that when the STP Phase 2 reporting is enabled, users will be able to update this information immediately without any impact on STP reporting.

In the Staff portal application, the Passport Country is the mandatory field in the Visa tab for the member in the Employment Details page as shown in the figure below.

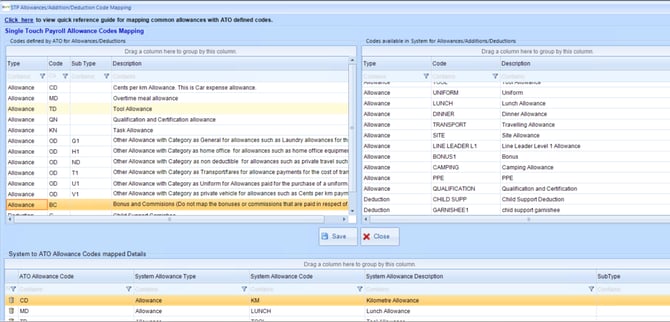

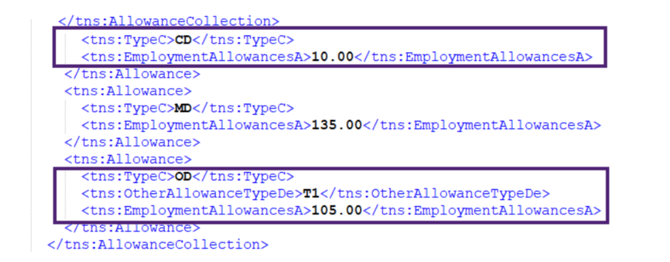

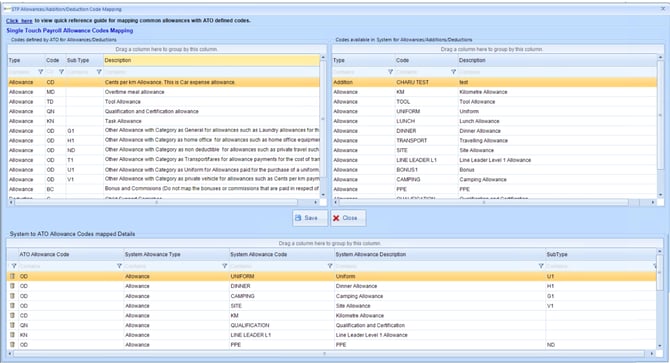

4. Review/Update all Allowances/Additions Settings in the Masters as per ATO Guidelines along with their Remapped Codes

In STP Phase 2, all the Allowances and Additions are itemised separately, not just expense allowances that may have been deductible on the employee’s IITR. This means that allowances and additions that used to be reported as Gross for the income type must now be separately itemised in STP Phase 2 reporting.

Also, STP Phase 2 introduces the ability to report the deductions for Child Support Garnishee/Child Support Deduction and eliminates the need for employers to provide separate remittance advice to the Child Support Registrar while reporting through STP. However, you need to pay the required amounts directly to ATO by the date specified in your notice.

ATO has defined mandatory obligations to report Child Support amounts through STP Phase 2, click to view the detailed information.

Click to view the details to review/update all the allowances and additions:

While transitioning from STP Phase 1 to STP Phase 2, the Entire OnHire team will update the master settings of all the allowances and additions to be selected as ‘Separately Itemise in STP’, except reimbursements (if any provided by you), as per the prerequisites document after STP Phase 2 rollout.

While transitioning from STP Phase 1 to STP Phase 2, all the existing Allowances and Additions codes will be remapped by the Entire OnHire team with the new codes defined as per ATO guidelines based on the data shared by you in the prerequisites document.

You need to review the remapped Allowances and Additions codes after the STP Phase 2 rollout and ensure that the codes are set as per your requirement for a successful STP run.

5. Change in Workers Holiday Maker Scale

As per the ATO obligation, the clients must be registered as an employer of Working Holiday Maker in case of employment or planning to employ workers who hold either:

-

Working Holiday visa (subclass 417) or

-

Work and Holiday visa (subclass 462)

The new Workers Holiday Maker Tax Scales are introduced in STP Phase 2. The two new tax scales added are Workers Holiday Maker Scale - Unregistered Employer, and Workers Holiday Maker Scale - No TFN Supplied.

Employers must be registered as Workers Holiday Maker before making the first payment to the employees. In case the employer is not a registered Workers Holiday Maker, the employer will have to deduct higher tax rates for the employees.

While transitioning from STP Phase 1 to STP Phase 2, the Entire OnHire team will be updating your Employer Worker Holiday Maker Registration Status settings as per the information provided by you. In case the status is not provided in the prerequisites document by you, the system will be set to ‘Registered Employer for Workers Holiday Maker’ after STP Phase 2 rollout.

In case, you are not registered as an employer of Working Holiday Makers, the Entire OnHire team will update your Workers Holiday Maker employees tax scale to Workers Holiday Maker Scale - Unregistered Employer after STP Phase 2 rollout. This will be set in case you have selected the option as ‘YES’ for the ‘Do you want us to update your Workers Holiday Maker employees tax scale to Workers Holiday Maker Scale - Unregistered Employer’ in the prerequisites document.

To view detailed information about each Workers Holiday Maker Tax Scale, click the respective links below:

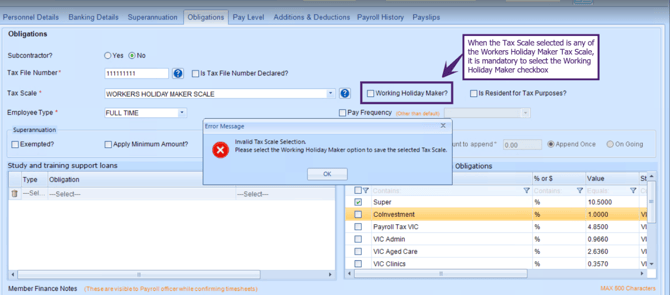

6. Validations to Restrict User to Change the Tax Scale from Workers Holiday Maker Scale to Australian Resident Scale and Vice versa

-

As per the ATO guidelines for STP Phase 2, the staff is restricted to update any Workers Holiday Maker Tax Scale, once the payrun for the member has been performed on the Australian Resident Tax Scale.

In the Finance application, when the staff changes the Tax Scale of the member to any Workers Holiday Maker Tax Scale from the selected Australian Resident Scale and the payrun of the member is already performed in the selected branch (with the Australian Resident Scale), the staff will get a validation pop-up on clicking the save button as shown in the figure below and staff will not be able to change the Tax Scale.

Similarly, in the Staff portal application, the staff is restricted to update any Workers Holiday Maker Tax Scale, once the payrun for the member has been performed on the Australian Resident Tax Scale.

-

As per the ATO guidelines for STP Phase 2, the staff is restricted to update any Australian Resident Tax Scale once the payrun for the member has been performed on the Workers Holiday Maker Tax Scale.

In the Finance application, when the staff changes the Tax Scale of the member to any Australian Resident Scale from the selected Workers Holiday Maker Scale and the payrun of the member is already performed in the selected branch (with the Workers Holiday Maker Scale), the staff will get a validation pop-up on clicking the save button as shown in the figure below and staff will not be able to change the Tax Scale. Similarly, in the Staff portal application, the staff is restricted to update any Australian Resident Tax Scale once the payrun for the member has been performed on the Workers Holiday Maker Tax Scale.

Similarly, in the Staff portal application, the staff is restricted to update any Australian Resident Tax Scale once the payrun for the member has been performed on the Workers Holiday Maker Tax Scale.

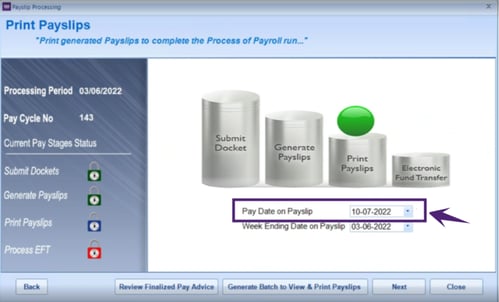

7. Payment Date by Entity

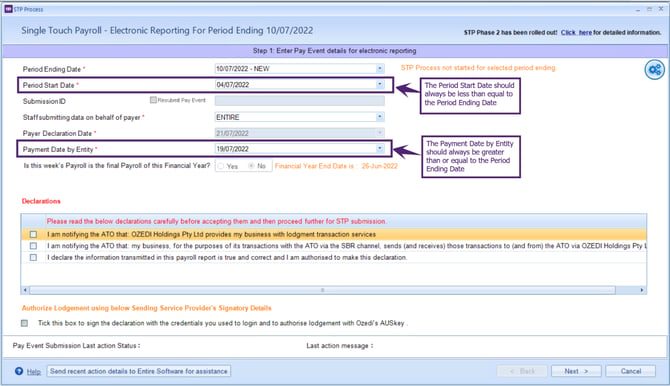

You should ensure to submit the STP run on or before the Payment Date. The Payment Date is the date when the payslip is processed. While processing the STP run, validations are in place for the Payment Date by Entity.

The Payment Date Header Tuple is created as shown in the figure below.

In the Finance Application, this Payment Date is picked from the selected Pay Date on Payslip in the Payslip Processing screen as shown in the figure below.

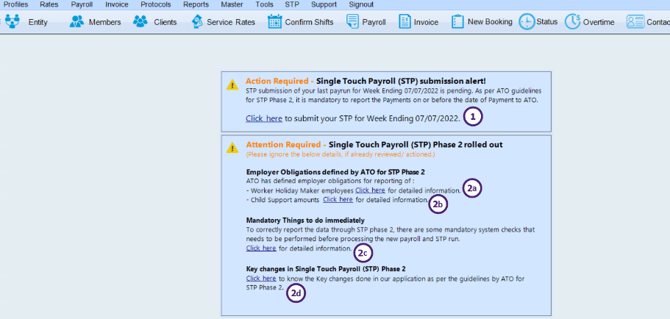

Help Alerts for STP Phase 2

To streamline and implement the STP Phase 2 effortlessly, our STP Phase 2 enabled application has incorporated the help alerts in all the required screens that will guide you through the additions/modifications to process Single Touch Payroll successfully.

Help Alerts in Finance Application

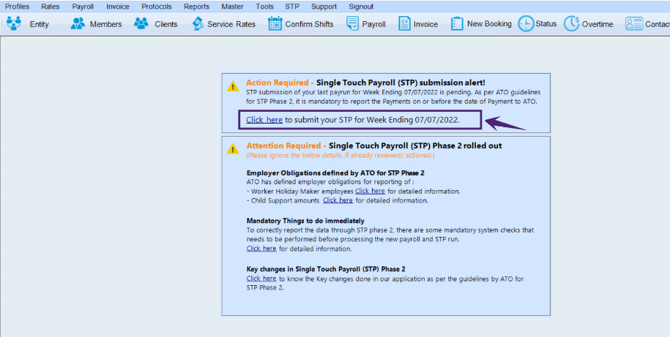

A. Help Alerts in Dashboard Screen

When you open the Finance application, the action/attention required details are available in the Dashboard screen. It is recommended to read and follow the instructions provided before proceeding with the new STP process.

-

Action Required - Single Touch Payroll (STP) submission alert!

-

Click here to submit your STP for Week Ending <date of week ending>

→Click this link to open the STP Process screen

-

-

Attention Required - Single Touch Payroll (STP) Phase 2 rolled out

Employer Obligations defined by ATO for STP Phase 2:-

Worker Holiday Maker employees. Click here for detailed information

→Click the link to open the Client Support knowledge base for the Workers Holiday Maker details in the STP Phase 2 -

Child Support amounts. Click here for detailed information

→Click the link to open the Client Support knowledge base for the Child Support amounts details in the STP Phase 2

Mandatory Things to do immediately: -

Click here for more information

→Click the link to open the ‘Things to do: Single Touch Payroll (STP) Phase 2 rolled out' pop-up window. You need to follow the mandatory system checklist that needs to be performed before processing the new payroll and STP runKey changes in Single Touch Payroll (STP) Phase 2:

-

Click here to know the key changes done in our application as per guidelines by ATO for STP Phase 2

→Click the link to open this section in the Client Support knowledge base

-

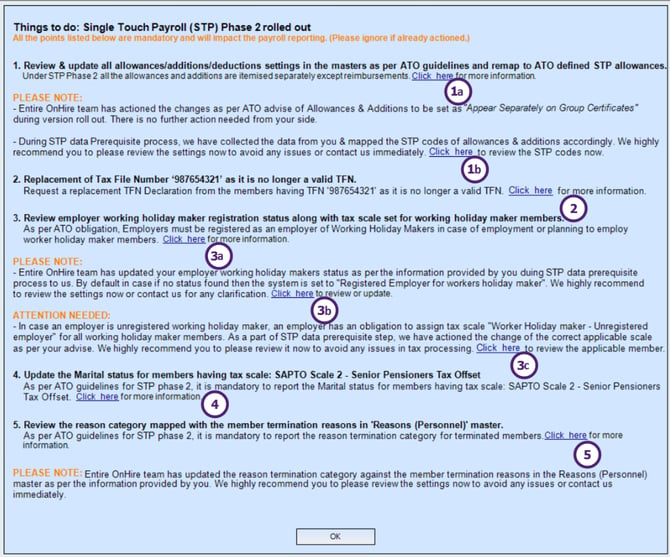

On clicking link 2c i.e., Mandatory Things to do immediately (as shown in the figure above), the Things to do: Single Touch Payroll (STP) Phase 2 rolled out pop-up window opens as shown in the figure below.

-

Review & update all allowances/additions/deductions settings in the masters as per ATO guidelines and remap to ATO defined STP allowances

-

Click here for more information → Click the link to open this section in the Client Support knowledge base

-

Click here to review the STP codes now → this link opens the STP Allowances/Addition/Deduction Code Mapping screen

-

-

Replacement of Tax File Number ‘987654321’ as it is no longer a valid TFN. Click here for more information → Click the link to open this section in the Client Support knowledge base

-

Review employer worker holiday maker registration status along with the tax scale set for working holiday maker members

-

Click here for more information → Click the link to open this section in the Client Support knowledge base

-

Click here to review or update → Click the link to open the Software Registration Details screen, to review the System Settings for Employer Worker Holiday Maker registration status

-

Click here to review the applicable member → Click the link to open the Member Payroll screen to review the correct applicable tax scale for the selected member

-

-

Update the Marital status for members having tax scale: SAPTO Scale 2 - Senior Pensioners Tax Offset. Click here for more information → Click the link to open this section in the Client Support knowledge base

-

Review the reason category mapped with the member termination reason in ‘Reason (Personnel)’ master. Click here for more information → Click the link to open this section in the Client Support knowledge base

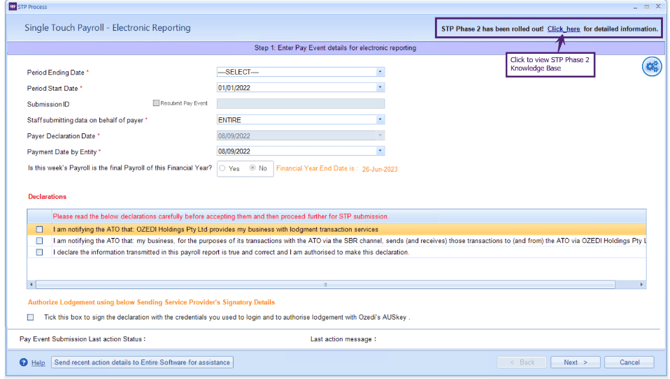

B. Help Alert in STP Process Screen

In the STP Process screen, an alert information message is displayed at the top-right corner of the screen. Click the hyperlink Click here, to view the detailed Client Support knowledge base regarding the STP Phase 2 expansion that will guide you to submit the STP report as per new guidelines issued by the ATO.

C. Help Alert in Allowances Master and Addition/Deduction Master Screen

In the Allowances screen, an alert information message is displayed regarding new STP Phase 2 guidelines issued by the ATO. Click the hyperlink Click here and the pop-up Changes in the ATO guidelines for reporting Allowances and Additions opens.

It is recommended to read the instructions carefully for the Allowances and Additions.

In the Additions and Deductions screen, alert information messages are displayed regarding new STP Phase 2 guidelines issued by the ATO.

-

All allowances and additions except reimbursements are now to be set as ‘Separately Itemise in STP’. Click here for more information. → Click the hyperlink, Click here and the pop-up ‘Changes in the ATO guidelines for reporting Allowances and Additions’ opens. It is recommended to read the instructions carefully

-

ATO has defined employer obligation for transitioning the reporting of Child Support Amount to STP Phase 2. Click the info icons adjacent to the Additions and Deductions Details and the related knowledge article opens that provides the details of each checkbox. It is recommended to read the instructions carefully

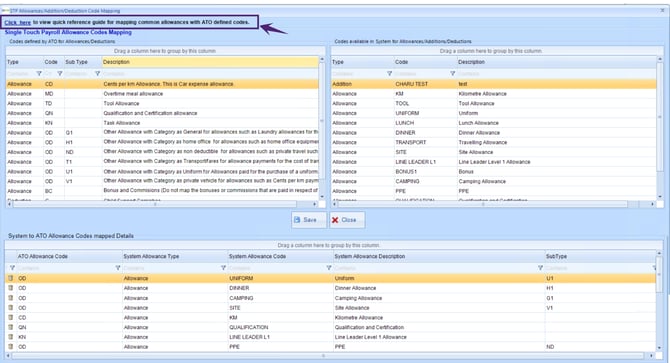

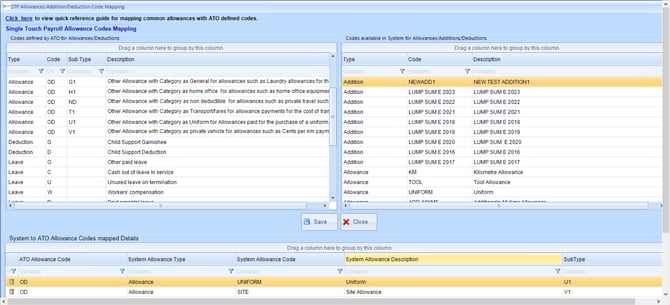

D. Help Alert in STP Allowances/Addition/Deduction Code Mapping Screen

In the STP Allowances/Addition/Deduction Code Mapping screen, an alert information message is displayed at the top-left corner of the screen. Click the hyperlink Click here to open the STP Phase 2 reporting – quick reference guide that will help you to check the common allowances with the ATO defined codes.

Help Alerts in Web Application

A. Help Alert in Create New Member

In the Create New Members page of the Staff portal application, a help icon is displayed next to the Tax Scale field. Click the help icon to view the STP Phase 2 Client Support knowledge base that will help you to understand the new changes related to the Workers Holiday Maker tax scales.

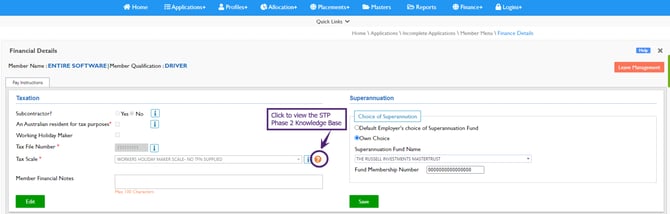

B. Help Alert in Member’s Finance Details

In the member's Finance Details page of the Staff portal application, a help icon is displayed next to the Tax Scale field. Click the help icon to view the STP Phase 2 Client Support knowledge base that will help you to understand the new changes related to the Workers Holiday Maker tax scales.

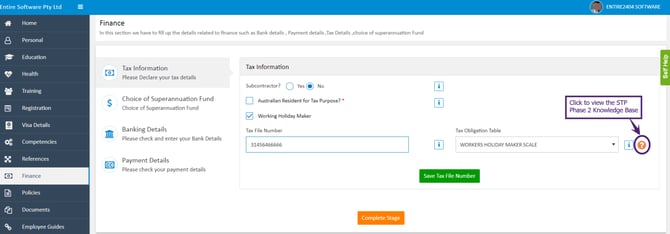

C. Help Alert in Applicant Portal for Finance

In the Finance page of the Applicant Portal application, a help icon is displayed next to the Tax Obligation Table field. Click the help icon to view the STP Phase 2 Client Support knowledge base that will help you to understand the new changes related to the Workers Holiday Maker tax scales.

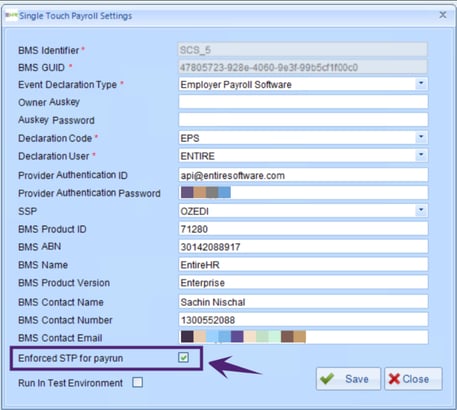

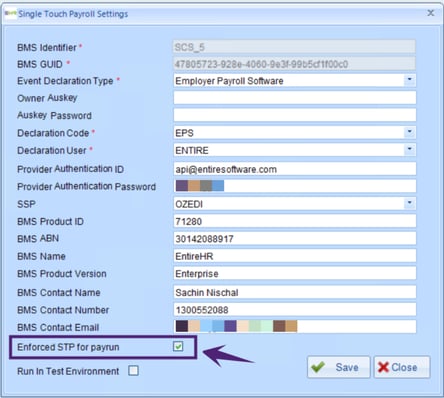

Enforced STP with Validation Messages

In the STP Phase 2 enabled Finance application, the Enforced STP for payrun flag ensures timely STP submissions i.e., you will be guided to submit STP run on or before the Payment Date. By default, this flag is enabled.

To view the Enforced STP for payrun flag, click STP → Single Touch Payroll Settings and the Single Touch Payroll Settings screen opens.

For the Enforced STP for payrun flag, the validation messages listed below appear in the respective screens as explained below.

1. STP Phase 2 Submission Alert: Week-ending Submission Alert on Dashboard

Click here to submit your STP for Week Ending <date of week ending> → On clicking the Click here link, the STP Process screen opens and you will be able to submit your STP for the Week Ending.

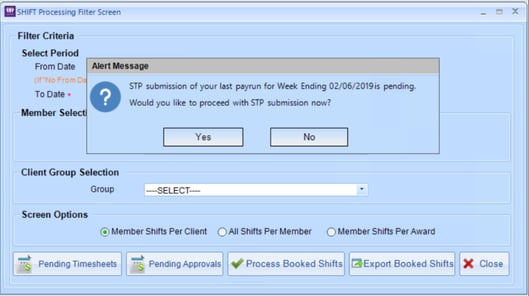

2. STP Phase 2 Submission: Alert Message in the Confirm Shifts

In the Shift Processing Filter screen, in case the user has not submitted the STP run for the immediate last Week Ending payrun for the selected branch (the last payrun performed by the staff) for the current financial year and if the pay date for that payrun is less than or equal to the current date, an alert message is displayed on clicking Process Booked Shifts as shown in the figure below.

Click Yes to proceed with the STP submission.

This alert message will not appear for the first Payrun of the current financial year set in the system and if the payrun subcontractors only.

3. Submit Dockets: Restrict Users to Submit Dockets until STP for the Last Payrun is Submitted

If the user has not submitted the STP run for the immediate last Week Ending payrun in the selected branch (the last payrun performed by the staff ) for the current financial year, on clicking the Submit Dockets, an alert message is displayed as shown in the figure below.

Note that submitting STP run indicates the step to Process Single Touch Payroll i.e., Submit Validated files to SSP for ATO Submission (Mandatory Step).

The user will not be able to proceed further until the STP for the last Payrun is submitted.

This alert message will not appear for the first Payrun of the current financial year set in the system.

4. STP Phase 2 Submission: Generate Batch for Payroll Processing

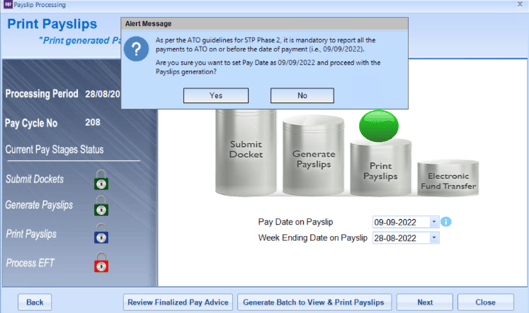

As per the ATO guidelines for STP Phase 2, it is mandatory to report all the Payments on or before the Pay Date.

In the Payslip Processing screen, click the Generate Batch to View & Print Payslips, and the alert message is displayed as shown in the figure below. To set the selected date as Pay Date, click Yes and proceed with the payslips generation.

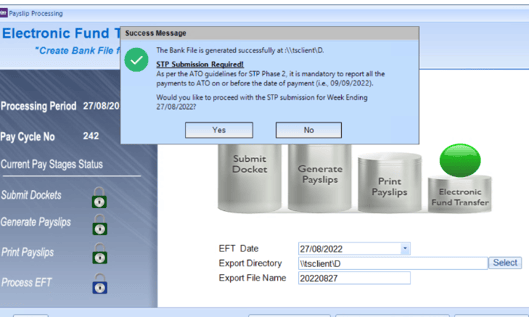

5. Success Message of EFT File Generation Provides the Option to Submit STP for the Payrun

While EFT file generation, the success pop-up message shows the STP Submission Required information. The user can proceed with the STP submission for the Week Ending by clicking Yes or else proceed further.

Note that in case the payrun has only subcontractors, the normal success pop-up appears without the details of STP Submission Required.

6. Restricting users to change the financial year dates

In the Payroll tab of the Application Options screen, the user will be restricted to change the financial year dates in case:

-

The Client has submitted at least one STP run in the current financial year

-

STP run for the last payrolls that the user performed in the branches for that financial year are not submitted by the user

For the above scenarios, if the user changes the financial year dates and clicks Save, an alert message is displayed as shown in the figure below.

The System will check the last payrun for every branch and if the STP is not submitted for the last payrun (for any of the branches), an alert message appears.

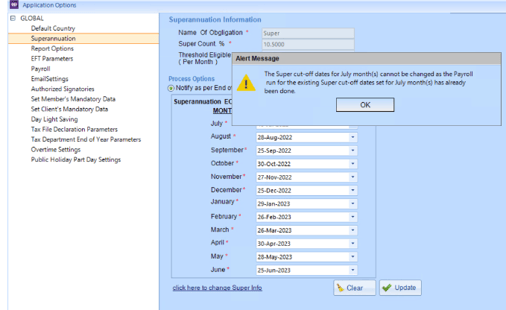

7. Restrict user to change the Super cut-off dates if payrun is performed for the existing cut-off date

In the Superannuation tab of the Application Options screen on modifying the Super Info, the system will check whether the user has performed the payroll for the existing Super cut-off date.

In case the payroll is already performed for the Super cut-off date of the current financial year (of the selected branch), and the user tries to change the Super cut-off date for that month, an alert message is displayed as shown in the figure below.

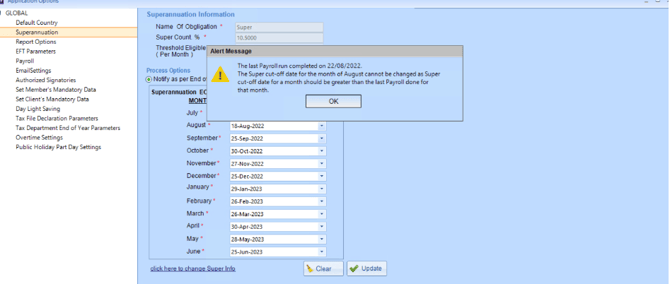

8. Restrict Users to Change the Super Cut-off Dates if the Cut-off date is Less than the Last Payroll Week Ending Date

In the Superannuation tab of the Application Options screen on modifying the Super Info, the system will check if the payrun is performed on the Super cut-off date for the selected branch.

If the payrun is not performed, the system will check whether the changed Super cut-off date is greater than the last payroll Week Ending date for the selected branch. In case the changed date is less than the last payroll Week Ending date, an alert message is displayed as shown in the figure below.

Validation to Generate Valid Data Files

The validations are placed to generate and validate data file that helps to provide a check to set the compliance of any output as compared to the input provided.

Validate Employee Details

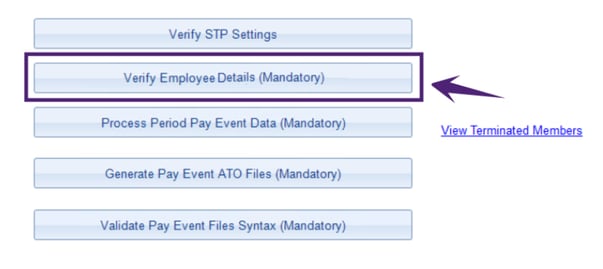

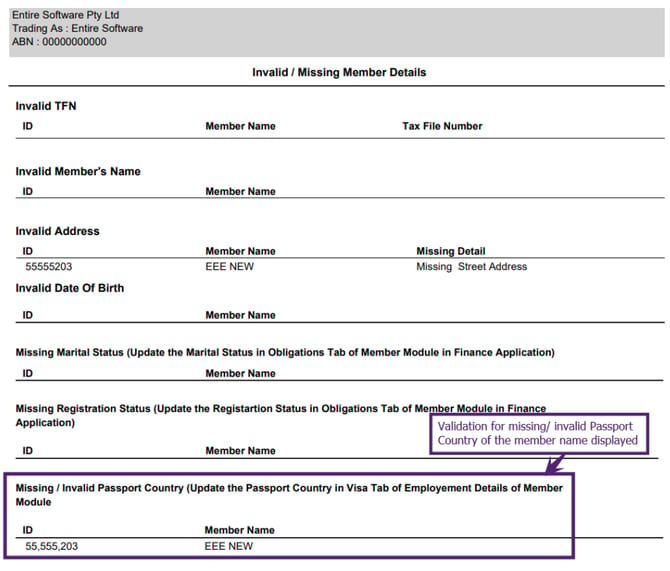

To validate the Employee Details, click Verify Employee Details (Mandatory) in the Finance application as shown in the figure below. In case any validation fails in generating the valid data file, a validation message appears "Employee(s) details are invalid or missing. Please check report." Refer to the Validation details in the Invalid/ Missing Member Details screen.

Validate SAPTO Scale 2 - Senior Pensioners Tax Offset Member Scale

In case the member’s Tax Scale selected is SAPTO Scale 2 - Senior Pensioners Tax Offset, the Marital Status value is validated. If the Marital Status value is not provided in the member module of the Finance application, a validation report is generated.

The user will not be able to proceed further unless the SAPTO Scale 2 - Senior Pensioners Tax Offset validation is successful. The validation message is displayed on clicking Verify Employee Details in the application as shown in the figure below.

Note that while Verifying Employee Details from the Finance application, all the validations explained below are compiled in the Invalid/ Missing Member Details and displayed with ID and Member Name.

Validate Workers Holiday Maker Member Scale

In case the member’s Tax Scale selected is any of the Workers Holiday Maker Scales and the Passport Country is not selected, the validation message is displayed on clicking Verify Employee Details in the application as shown in the figure below.

In the Staff portal application, ensure to select the Passport Country for the member having tax scales as Workers Holiday Makers in the Employment Details Page.

Validate STP Dates

Validate the Dates while processing Single Touch Payroll.

-

The Period Start Date should always be less than or equal to the Period End Date

-

The Payment Date by Entity should always be greater than or equal to the Period Ending Date

Validate Tax File Number and Tax Scale at Generate Payslip Stage

The following validations are provided in the system for the Tax File Number and Tax Scale at the Generate Payslip Stage:

-

In case the member has TFN ‘111111111’ saved in the Member module for more than 28 days, the staff will not be able to generate the payslip

The validation message appears ‘Please change the TFN of the member to ‘000000000’ and the Tax Scale to ‘SCALE 4 - NO TFN BY RESIDENT OBLIGATIONS’ if the member is an Australian Resident and ‘SCALE 5 - NO TFN BY NON-RESIDENT OBLIGATIONS’ if the member is Foreign Resident as even after 28 days TFN is awaiting to be provided by the member' as shown in the figure belowWhen the Staff changes the member’s TFN to ‘000000000’ and the Tax Scale to ‘SCALE 4 - NO TFN BY RESIDENT OBLIGATIONS’ or 'SCALE 5 - NO TFN BY NON RESIDENT OBLIGATIONS’, the payslip of the member will be generated successfully

Note that the validation will appear for both cases i.e. if the TFN is not changed or the Tax Scale is not changed

-

In case the Working Holiday Maker (WHM) member has TFN ‘111111111’ saved in the Member module for more than 28 days, the staff will not be able to generate the payslip

The validation message appears ‘Please update the TFN of the member to ‘000000000’ and the Tax Scale to ‘WORKERS HOLIDAY MAKE SCALE - NO TFN SUPPLIED’ as even after 28 days TFN is awaiting to be provided by the member' as shown in the figure below

When the Staff changes the member’s TFN to ‘000000000’ and the Tax Scale to 'WORKERS HOLIDAY MAKE SCALE - NO TFN SUPPLIED’, the payslip of the member will be generated successfully

Note that the validation appears for both cases i.e. if the TFN is not changed or the Tax Scale is not changed

-

In case the Workers Holiday Maker member has Tax Scale ‘WORKERS HOLIDAY MAKER SCALE’ saved in the Member module and the Employer is set as Unregistered in the Application Options, the staff will not be able to generate the payslip

The validation message appears ‘Please update the Tax Scale of the member to ‘WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER’ as your company is unregistered with ATO to employ a working holiday maker' as shown in the figure below

When the Staff changes the member’s Tax Scale to 'WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER', the payslip of the member will be generated successfully

-

In case the Workers Holiday Maker member has Tax Scale ‘WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER’ saved in the Member module and the Employer is set as Registered in the Application Options, the staff will not be able to generate the payslip

The validation message appears ‘Please update the Tax Scale of the member to ‘WORKERS HOLIDAY MAKER SCALE’ as your company is registered with ATO to employ a working holiday maker' as shown in the figure below

When the Staff changes the member’s Tax Scale to 'WORKERS HOLIDAY MAKER SCALE', the payslip of the member will be generated successfully

-

In case the Workers Holiday Maker member has Tax Scale ‘WORKERS HOLIDAY MAKER SCALE - NO TFN SUPPLIED’, the employer will get validation at the generate payslip stage to change the employee’s tax scale to ‘WORKERS HOLIDAY MAKER SCALE' or 'WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER’ based on the employer Workers Holiday Maker status set in the system except in the case when the member has valid TFN number or the TFN provided is '111111111' and it has been less than 28 days since the request for the TFN declaration was performed

When the staff changes the member’s Tax Scale to ‘WORKERS HOLIDAY MAKER SCALE' or to the 'WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER’, the payslip of the member will be generated successfully

Pay Event Header File

Payer Postal Address

In Payer Postal Address following elements are added:

-

Payer Postcode

-

Payer Country Code

The following elements are removed:

-

Payer Address Line 1

-

Payer Address Line 2

-

Payer Suburb/ Town

-

Payer State/ Territory

The Payer Postal Address Header Tuple is created as shown in the figure below.

Child Support Deductions

Child Support deductions arise from a legal agreement administered by Services Australia - Child Support for a separated parent, to pay periodic amounts of child support from their salary and wages for the benefit of their child or children. These periodic amounts are advised to both the child support employer and employee via a child support account statement, detailing recent payments transferred to the employee and ongoing liabilities for child support to the employer. Child support deductions must continue to be withheld and reported until another notice is received from Child Support to alter or cease the previous instruction.

Where an employer reports these amounts through STP, it will extinguish their obligations to separately report these amounts directly to the Child Support Registrar (the Registrar). Employers who do not report these amounts under STP are still required to report to the Registrar. Where the Registrar has given written notice to employers to deduct a specified amount from employees, employers are obliged to withhold money from employees and pay it to the Registrar.

Two different types of Child Support Amounts can be reported through our Finance application:

-

Child Support Deductions (D)

-

Child Support Garnishees (G)

Mandatory Obligations to Report Child Support Amounts Through STP Phase 2

Employers may voluntarily choose to report their child support amounts through STP Phase 2 and may elect to commence reporting child support amounts upon/after transitioning to STP Phase 2. Employers may choose to move from STP Phase 2 in order to be able to report child support amounts.

The following transition rules apply when the employer elects to report child support amounts via STP Phase 2:

-

The STP report must be accompanied by the existing child support report form and manually provided to the Child Support Registrar for the pay period amounts by the employer. Manual reporting can be completed with the child support deductions report form (CS4964) using existing Child Support channels

-

Where an employer is commencing reporting child support garnishee amounts via STP, the payment instructions the employer was previously using will need to be updated, to ensure the employer uses their employer reference number, instead of the previously used employee reference number. A new S72A garnishee notice will be issued by the Child Support Registrar to the employer upon his request. If an incorrect payment reference number is used, Child Support will not be able to reconcile the employer’s child support record

When the above stated mandatory obligations are met, the employer needs to map Child Support Amounts as explained below.

With the employer completing both an STP report and a manual report for the same period, Child Support is able to calculate the initial period amounts associated with each employee.

Child Support Deduction

The Child Support Deduction is a fixed dollar amount for each pay period. In STP Phase 2, the employer must report child support amounts to the Commissioner on or before the employee’s pay date.

Employers cannot make a deduction of child support that leaves the employee with a net pay, after tax and child support deductions, of less than the Protected Earnings Amount (PEA). You also must report zero amount as a Child Support deduction when processing the payrun for the employee, where you are unable to make child support withholdings due to insufficient wages of the employee.

Protected Earning Amount (PEA) is a legally prescribed value of post-tax net pay that must be paid to the employee from their salary or wages after their child support deduction has been withheld. It is indexed annually and updated by Services Australia on the 1st of January each year.

As the deduction notice specifies exact pay periods and amounts, if a child support deduction amount cannot be fully withheld due to the Protected Earning Amount (PEA), any future retrospective amounts that apply to this pay period, must be taken into consideration to address the shortfall amount.

You need to evaluate and deduct the child support deduction amount in the Finance application taking into consideration the Protected Earning Amount (PEA) defined by the Child Support Registrar.

An employer’s obligations are satisfied when child support amounts are reported and also paid directly to the Child Support Registrar. If an employer does not notify the Commissioner of Taxation via STP, the employer must adhere to their notification obligations under section 47 of the Child Support (Registration & Collection Act), which requires the employer to report directly to the Child Support Registrar.

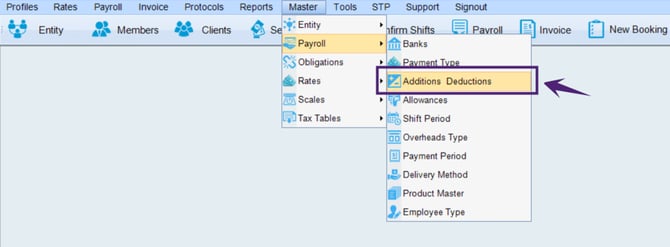

In the Finance application, open the Additions and Deductions screen to declare the Child Support Deduction.

To open the Additions and Deductions master screen, select Master → Payroll → Additions Deductions.

In the Additions and Deductions, a new checkbox is added as Child Support Deduction. You can either select the Child Support Deduction or Child Support Garnishee checkbox to report the child support amounts. For deduction, select the Child Support Deduction checkbox and for garnishee, select the Child Support Garnishee checkbox.

The Child Support Deduction checkbox will be disabled when creating/ updating additions.

The Separately Itemise in STP checkbox is selected by default in a disabled mode in case of the Child Support Deduction checkbox is checked.

STP Phase 2 introduces the ability to report the deductions for Child Support Deduction, eliminating the need for employers to provide separate remittance advice to the Child Support Registrar while reporting through STP. However, you will need to pay the required amounts directly to ATO by the date specified in your notice.

Note that the reporting of Child Support through STP is voluntary and you may prefer not to report through STP consequently, no preparation is required for the STP Phase 2 to report Child Support Amount. The employers still need to report directly to the Child Support Registrar on an ongoing basis.

ATO has defined mandatory obligations to report Child Support amounts through STP Phase 2, click to view the detailed information.

-

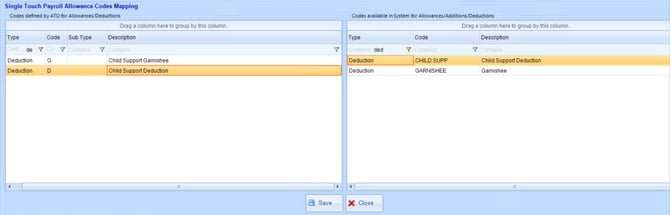

Click STP

→Allowances Mapping and Single Touch Payroll Allowance Codes Mapping screen opens -

Now, you need to map Codes defined by ATO for Allowances/Deductions with the Codes available in the System for Allowances/Additions/Deductions for Child Support Deduction

-

For Deduction type as Child Support Deduction map with Code as ‘D’ as defined by ATO

Employers cannot make a deduction of child support that leaves the employee with a net pay, after tax and child support deductions, of less than the Protected Earnings Amount (PEA). You also must report zero amount as Child Support deduction when processing the payrun for the employee, where you are unable to make child support withholdings due to insufficient wages of the employee.

Protected Earning Amount (PEA) is a legally prescribed value of post-tax net pay that must be paid to the employee from their salary or wages after their child support deduction has been withheld. It is indexed annually and updated by Services Australia on the 1st of January each year.

As the deduction notice specifies exact pay periods and amounts, if a child support deduction amount cannot be fully withheld due to the Protected Earning Amount (PEA), any future retrospective amounts that apply to this pay period, must be taken into consideration to address the shortfall amount.

You need to evaluate and deduct the child support deduction amount in the Finance application taking into consideration the Protected Earning Amount (PEA) defined by the Child Support Registrar.

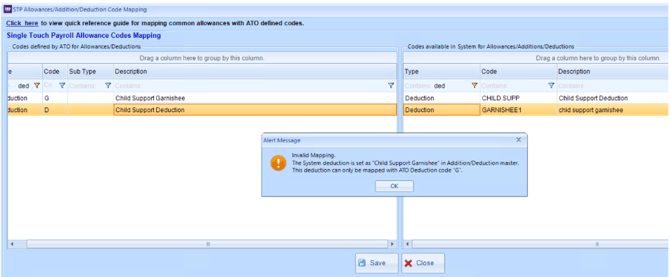

In case codes defined by ATO for Allowances/Deductions are incorrectly mapped with the Codes available in the System for Allowances/Additions/Deductions for the Child Support Deduction, a validation message is displayed as shown in the figure below.

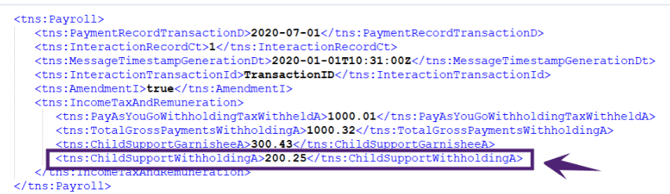

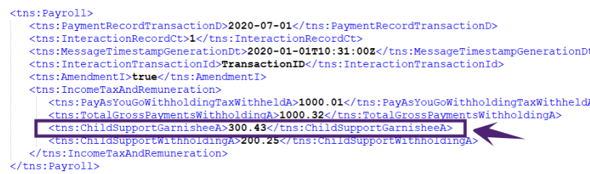

The Child Support Deduction (D) Tuple is created if the child support deduction for that payrun exists as shown in the figure below.

Child Support Garnishee (G)

Reporting of Child Support Garnishee is optional for employers and is not mandated by Child Support law. In STP Phase 2, the employer may report Child Support Garnishee amounts to the Commissioner on or before the employee pay date.

The Child Support Garnishee (G) requires an employer to deduct a percentage of the employee’s income, lump sum, or a fixed amount for each pay period. You should report these amounts in your STP report as Deduction Type 'G'.

The employer obligations are satisfied when payment of the Child Support Garnishee amount is received by the Child Support Registrar, not when the amount is reported.

Map Child Support Garnishee

ATO has defined mandatory obligations to report Child Support amounts through STP Phase 2, click to view the detailed information.

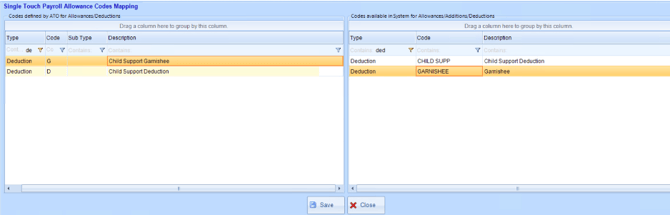

As defined for the Child Support Deduction, you can map Codes defined by ATO for Allowances/ Deductions with the Codes available in System for Allowances/ Additions/ Deductions for Child Support Garnishee.

- For Deduction type as Child Support Garnishee map with Code as ‘G’ as defined by ATO

In case codes defined by ATO for Allowances/ Deductions are incorrectly mapped with the Codes available in System for Allowances/ Additions/ Deductions for Child Support Garnishee, a validation message is displayed as shown in the figure below.

The Child Support Garnishee (G) Tuple is created if the child support garnishee for that pay run exists as shown in the figure below.

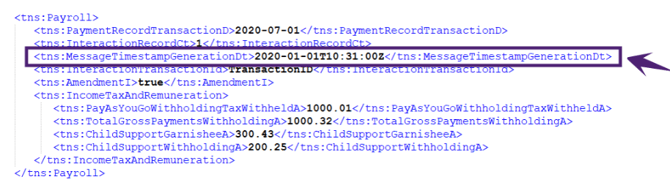

Run Date/ Time Stamp

The Run Date/ Time Stamp must always be set to the date/time when the YTD amount is attributed discretely to the pay result (created by the pay run) reported on the Submit action. This is the date when the payment is performed by an entity and picks the value of the date/time when the payrun is finalised.

The Run Date/Time Stamp tuple is created that shows the date/time when the payment was done by an entity. The timestamp is shown in UTC format that includes the Z for Zulu time to allow the ATO to convert to a consistent local time.

BMS GUID

Note that the key change BMS GUID of the STP Phase 2 is activated from Financial Year 2023-24.

The BMS GUID is a unique business identifier and is followed as per standards for the client. This BMS GUID is used to manage the reporting of payroll information to the ATO via STP. The employer uses this unique identifier, a serial number, to identify which instance of the business’s payroll software created the data in the pay event. This accommodates businesses that have more than one payroll system and businesses that change from one payroll system to another.

The Entire OnHire team has configured your BMS GUID Identifier. This BMS GUID is a non-editable field in the Single Touch Payroll Settings screen of the Finance application.

In case the BMS GUID does not exist in your application, a validation message ‘STP GUID is not configured in the application. Please contact Entire Support Team to configure it' appears on clicking Process Single Touch Payroll.

The BMS GUID Header Tuple is created as shown in the figure below.

Pay Event Employee File

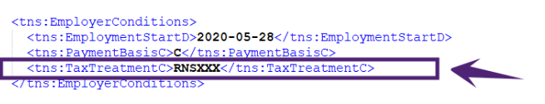

Tax Treatment/Income Stream Codes

The Tax Treatment and Income Stream Codes are generated based on the selected Tax Scale for the employee and are sent to ATO. The Tax Treatment code is a six-character code and the Income Stream Type Code is a three-character code for each employee.

Refer to the Tax Scales and their corresponding Tax Treatment and Income Stream Codes in the below table for any particular Tax Scale:

|

Tax Scales |

Char 1 |

Char 2 |

Char 3 (STSL) |

Char 4 (MLS) |

Char 5 (MLE) |

Char 6 (MLR) |

Income Stream Code |

|

SCALE 1 - NON TAX FREE THRESHOLD |

R |

N |

S/X |

X |

X |

X |

SAW |

|

SCALE 2 - TAX FREE THRESHOLD |

R |

T |

S/X |

X |

X |

X |

SAW |

|

SCALE 3 - FOREIGN RESIDENTS |

F |

F |

S/X |

X |

X |

X |

SAW |

|

SCALE 4 - NO TFN BY RESIDENTS |

N |

A |

X |

X |

X |

X |

SAW |

|

SCALE 5 - NO TFN BY NON RESIDENTS |

N |

F |

X |

X |

X |

X |

SAW |

|

SCALE 6 - FULL MEDICARE LEVY EXEMPT |

R |

T |

X |

X |

F |

X |

SAW |

|

SCALE 7 - HALF MEDICARE LEVY EXEMPT |

R |

T |

X |

X |

H |

X |

SAW |

|

CUSTOM - 31 PERCENT |

R |

N |

S/X |

X |

X |

X |

SAW |

|

SAPTO SCALE 2 - SENIORS PENSIONERS TAX OFFSET |

S |

S/M/I |

S/X |

X |

X |

X |

SAW |

|

WORKERS HOLIDAY MAKER SCALE |

H |

R |

X |

X |

X |

X |

WHM |

|

WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER |

H |

U |

X |

X |

X |

X |

WHM |

|

WORKERS HOLIDAY MAKER SCALE - NO TFN SUPPLIED |

H |

F |

X |

X |

X |

X |

WHM |

Note that 'S' in Char 3 is included in case STSL is selected against the member else X is included. No STSL is permitted for Scale where only X is mentioned and not S/X.

In the Member Payroll, based on the selected Obligations, the Tax Treatment codes are generated by default in the System.

The Tax Treatment Code Tuple is created after selecting the Tax Obligations as shown in the figure below.

The Income Stream Type Code Tuple is created after selecting the Income Stream as shown in the figure below.

Commencement Date

The Commencement Date is mandatory for the pay events with a Pay/Update date after ‘30/06/2020’. If the employer does not have a historical commencement date, the default value of ‘01/01/1800’ will be reported.

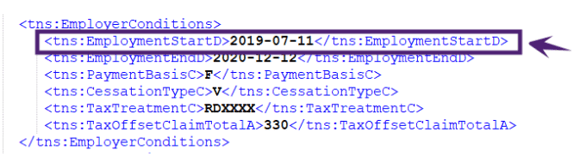

The Commencement Date Tuple is created that shows the employment start date.

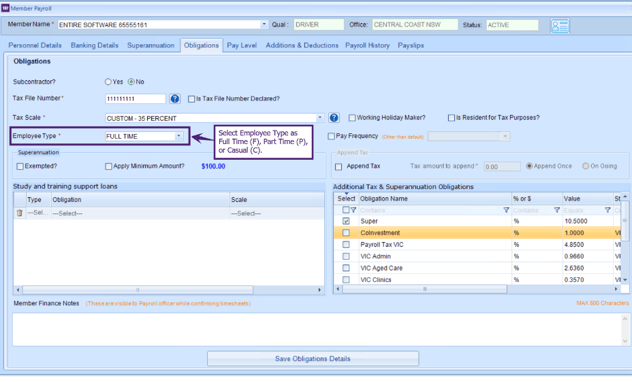

Employment Basis Code

The Employment Type is declared in the TFN Declaration form of the member in the web application.

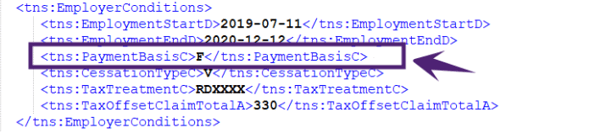

If the Employment Type is not declared by the member in the TFN Declaration form, in that case, the Employment Basis Code is picked from the Employee Type in the Member Payroll of the Finance application. This captures Employment Basis Code and is used in the STP.

The Employee Type ‘C' will be reported for Casual, ‘P’ for Part Time, and, 'F’ for Full Time as the Employment Basis Code. In case the Employee Type is different than the provided options, in that case, Employee Type reported will be Casual (C).

The Employee Basis Code Tuple is created that shows the employment type as Full Time (F), Part Time (P), or Casual (C).

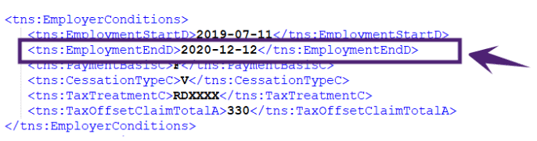

Cessation Date

In case your employees leave the organisation, reporting their cessation date and the reason reduces the need for you to provide a separation certificate.

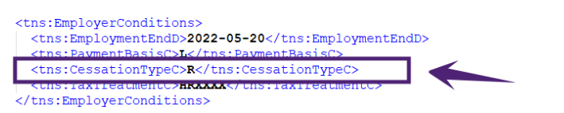

The Cessation Date Tuple is created that shows the employment end date.

Cessation Type Code

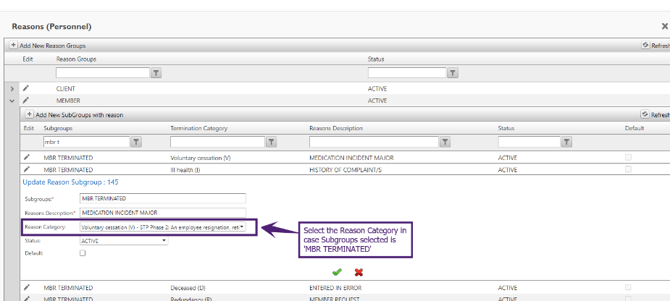

As per ATO guidelines for STP phase 2, it is mandatory to report the termination reason in the Reason Category for the terminated members.

In the Reasons (Personnel) Master of the Staff portal application, review the Reason Category, in case the termination reason for the Subgroups selected is 'MBR TERMINATED' for the member.

The Termination Category can be Voluntary (V), Ill health (I), Deceased (D), Redundancy (R), Dismissal (F), Contract Cessation (C), or Transfer (T).

The Entire OnHire team will be updating the Reason Category against the member termination reasons in the Reasons (Personnel) master as per the information provided by you after the STP Phase 2 rollout.

At the time of STP submission, in case Reason Category is not selected for the terminated members, by default Cessation Type Code 'R' is selected.

Refer to the Cessation Type and their corresponding codes in the below table for any particular cessation type:

|

Cessation Type |

Codes |

Description |

|

Voluntary Cessation |

V |

An employee resignation, retirement, domestic or pressing necessity, or abandonment of employment. |

|

Ill health |

I |

An employee resignation due to a medical condition that prevents the continuation of employment, such as illness, medically unfit, or permanent disability. |

|

Deceased |

D |

Death of an employee. |

|

Redundancy |

R |

An employer-initiated termination of employment due to a genuine redundancy or approved early retirement scheme. |

|

Dismissal |

F |

An employer-initiated termination of employment due to dismissal, inability to perform the required work, misconduct, or inefficiency. |

|

Contract Cessation |

C |

The natural conclusion of a limited employment relationship due to contract/ engagement duration or task completion, seasonal work completion, or to cease casuals that are no longer required. |

|

Transfer |

T |

The administrative arrangements are performed to transfer employees across payroll systems, move them temporarily to another employer (machinery of government for public servants), transfer of business, and move them to outsourcing arrangements or other such technical activities. |

The Cessation Type code mapped against the Reason Category is reported as the Cessation Type Code to ATO at the time of STP submission.

The Cessation Type Code Tuple is created that shows the Reason Category as Voluntary (V), Ill health (I), Deceased (D), Redundancy (R), Dismissal (F), Contract Cessation (C), or Transfer (T).

SAPTO Scale 2 - Senior Pensioners Tax Offset

As per ATO guidelines for STP phase 2, it is mandatory to report the Marital Status for the members having tax scale as SAPTO Scale 2 - Senior Pensioners Tax Offset.

In the Member Payroll screen of the Finance application, when the user selects ‘SAPTO Scale 2’ as the Tax Scale, a hyperlink appears to update the Marital Status as shown in the figure below. Click the link to update the Marital Status as Single, Married, or Illness Separated.

On selecting any one of the options, the following tax treatment code is included:

-

for Single

→Char 2 is 'S' -

for Married

→Char 2 is 'M' -

for Illness Separated

→Char 2 is 'I'

Click ‘Save Obligations Details’ to save the Member Obligation Details.

In the Staff portal application:

-

In the Create New Members page, the user needs to report the Marital Status of the members having the tax scale as SAPTO Scale 2 - Senior Pensioners Tax Offset. In the Create New Members page, when you select the Tax Scale as SAPTO Scale 2, click the hyperlink to select the Marital Status as shown in the figure below

-

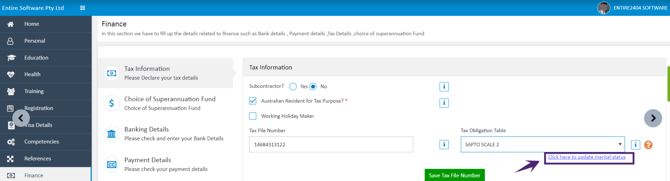

For the existing member, the user needs to report the Marital Status of the members having the tax scale as SAPTO Scale 2 - Senior Pensioners Tax Offset. In the Financial Details page, when you select the Tax Scale as SAPTO Scale 2, click the hyperlink to select the Marital Status as shown in the figure below

In the Applicant portal application, an applicant needs to report the Marital Status having tax scale as SAPTO Scale 2 - Senior Pensioners Tax Offset. In the Finance page, when the applicant selects the Tax Obligation Table as SAPTO Scale 2, click the hyperlink to select the Marital Status as shown in the figure below.

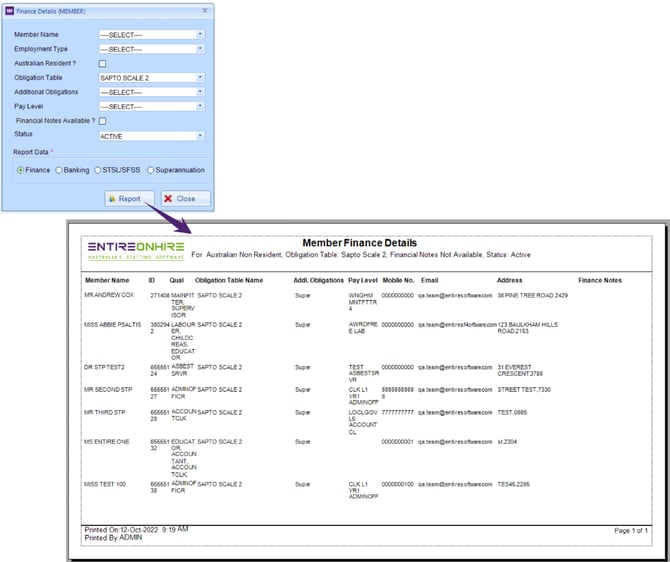

How to Generate Existing Members List having Tax Scale as “SAPTO Scale 2 - Senior Pensioners Tax Offset”?

In the Finance application, to generate the list of the existing members having Tax Scale as SAPTO Scale 2 - Senior Pensioners Tax Offset:

-

Click Reports

→Member→Member Finance Details and the Finance Details (Member) pop-up window opens -

In the Obligation Table, select SAPTO SCALE 2

-

In the Report Data, select Finance and click Report, and the Member Finance Details report is generated that includes the list of members with the SAPTO Scale 2 as shown in the figure below

Workers Holiday Maker

As per the ATO obligation, the clients must be registered as an employer of Working Holiday Maker in case of employment or planning to employ workers who hold either:

-

Working Holiday visa (subclass 417) or

-

Work and Holiday visa (subclass 462)

The new Workers Holiday Maker Tax Scales are introduced in STP Phase 2. The two new tax scales added are the Workers Holiday Maker Scale - Unregistered Employer, and Workers Holiday Maker Scale - No TFN Supplied.

Employers must be registered as Workers Holiday Maker before making the first payment to the employees. In case the employer is not registered as a Workers Holiday Maker, the employer will have to deduct higher tax rates for the employees.

While transitioning from STP Phase 1 to STP Phase 2, the Entire OnHire team will be updating your Employer Worker Holiday Maker registration status settings as per the information provided by you. In case the status is not provided in the prerequisite document by you, the system will be set to ‘Registered Employer for Workers Holiday Maker’ after the STP Phase 2 rollout.

In case, you are not registered as an employer of Working Holiday Makers, the Entire OnHire team will update your Workers Holiday Maker employees tax scale to Workers Holiday Maker Scale - Unregistered Employer after STP Phase 2 rollout. This will be set in case you have selected the option as ‘YES’ for the ‘Do you want us to update your Workers Holiday Maker employees tax scale to Workers Holiday Maker Scale - Unregistered Employer’ in the prerequisites document.

Now the Workers Holiday Maker Tax Scale is categorised as Workers Holiday Maker Scale, Workers Holiday Maker Scale - Unregistered Employer, and Workers Holiday Maker Scale - No TFN Supplied.

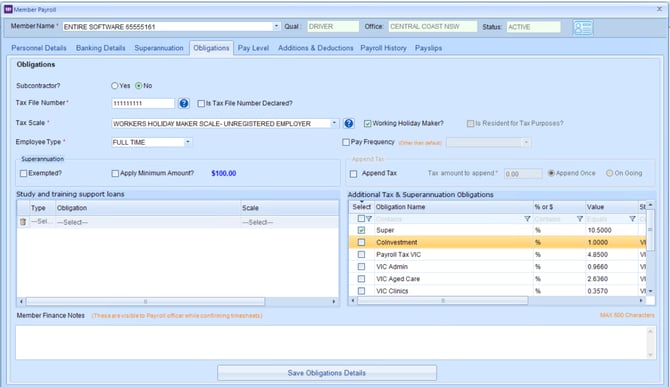

In the Obligation tab of the Member Payroll screen, on clicking the Working Holiday Maker checkbox, the Tax Scale as Workers Holiday Maker Scale is selected.

Workers Holiday Maker Scale

When the Employer of Workers Holiday Maker (WHM) is Registered, the Workers Holiday Maker Scale is selected as shown in the figure below.

As per the ATO guidelines, before making any payments to WHM employees, the employer must register with the ATO as a Working Holiday Maker Employer and must be registered for PAYG (pay as you go) withholding tax.

The validation message appears while saving the Obligations Details, in case no value is selected in the Tax Scale drop down.

The Employer Worker Holiday Maker registration status can be viewed/updated from the System Settings tab of the Software Registration Details screen in the Finance application as shown in the figure below.

Review the settings and change the status to Registered/Unregistered in the Employer Worker Holiday Maker registration status. Note that by default Registered status is selected for WHM.

To update the Employer Worker Holiday Maker registration status in the System Settings tab:

-

Click Update Software Registration Details

-

Select the new registration status and click Update Software Registration Details and the details are updated successfully

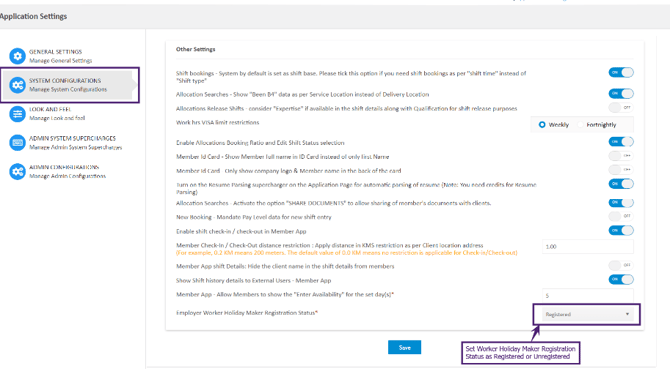

You can also set the Employer Worker Holiday Maker registration status in the Staff portal application:

-

Click the user login drop-down in the Entire Recruit application and open the Application Settings

-

In the Application Settings, click System Configurations

-

In the Other Settings, set the Employer Worker Holiday Maker registration status as Registered or Unregistered

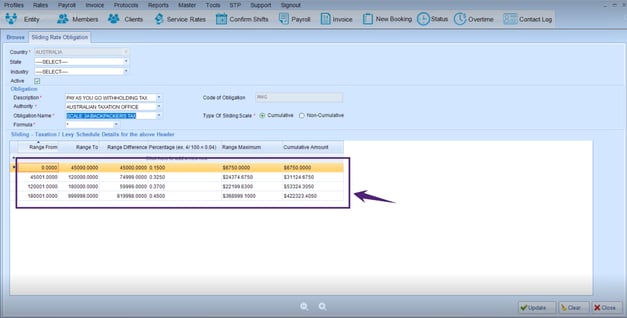

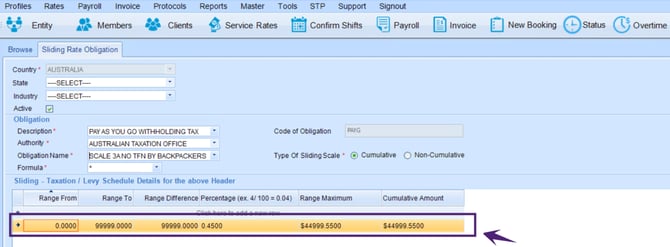

Sliding Rate Obligations

For the Workers Holiday Maker scale, below is the Sliding Rate Obligations range applicable.

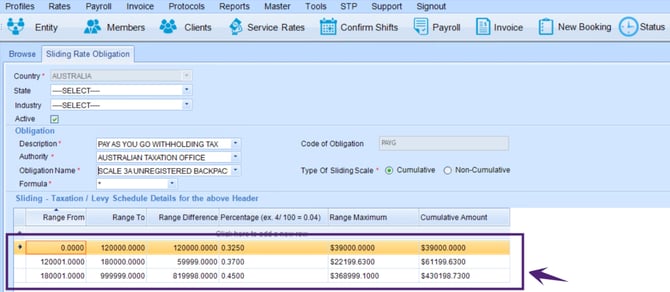

Workers Holiday Maker Scale - Unregistered Employer

In case the Client is not registered as an employer of Workers Holiday Maker, review the setting Employer Worker Holiday Maker registration status is set to Unregistered.

While transitioning from STP Phase 1 to STP Phase 2, in case you are not registered as an employer of Working Holiday Makers, the Entire OnHire team will update your Working Holiday Makers members tax scale as Working Holiday Makers - Unregistered Employer as per your employer registration status for Workers Holiday Maker provided by you after STP Phase 2 rollout.

The Tax Scale for the Workers Holiday Maker members in the Member module should be 'WORKERS HOLIDAY MAKER SCALE - UNREGISTERED EMPLOYER' before processing the Payrun in STP Phase 2.

Sliding Rate Obligations

For the Workers Holiday Maker - Unregistered Employer tax scale, below is the Sliding Rate Obligations range applicable.

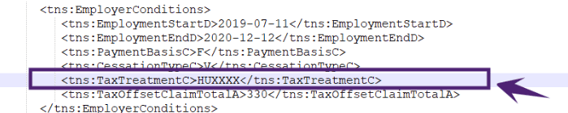

In the Member Payroll screen, when the user selects ‘Workers Holiday Maker Scale - Unregistered Employer’ as the Tax Scale, the Tax treatment code generated is HUXXXX.

While processing STP, the validation message appears in case the home country for the member is not selected similar to the Workers Holiday Maker Scale.

The Tax Treatment Code Tuple is created after selecting the Tax Obligations as the ‘Workers Holiday Maker Scale - Unregistered Employer ’ scale as shown in the figure below.

Workers Holiday Maker Scale - No TFN Supplied

The Workers Holiday Maker Scale - No TFN Supplied is selected when a Workers Holiday Maker member fails to provide TFN and it has been more than 28 days since the request for the TFN Declaration was performed. When the STP file is generated for the member with this scale, the member’s home country and Income stream type as WHM are selected.

Sliding Rate Obligations

For the Workers Holiday Maker - No TFN Supplied tax scale, below is the Sliding Rate Obligations range applicable.

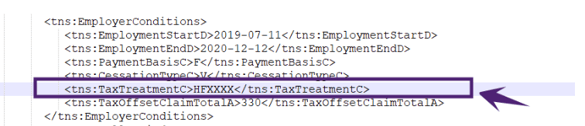

In the Member Payroll screen, when the user selects ‘Workers Holiday Maker Scale - No TFN Supplied’ as the Tax Scale, the Tax Treatment code generated is HFXXXX.

The Tax Treatment Code Tuple is created after selecting the Tax Obligations as the ‘Workers Holiday Maker Scale - No TFN Supplied’ scale as shown in the figure below.

How to Generate Existing Members List having TFN ‘000 000 000’?

In the Staff portal application, to generate the list of the existing members having TFN ‘000000000’:

-

Click Reports

→Member Reports→Member Detail Report and the Member Report opens -

Select the filter option as the Financial Details option and click Export Members Report to Excel and the Members Detail Report is downloaded

-

Open the CSV file to fetch the list of members by filtering TFN ‘000000000’

Validations for Workers Holiday Maker

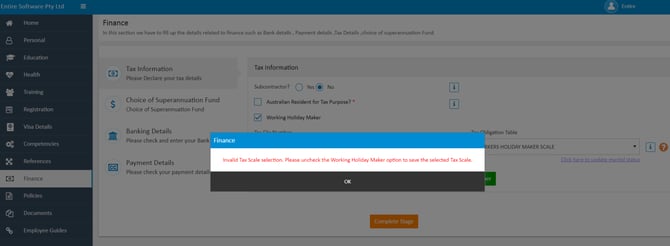

1. In the Finance application, in case the user selects any of the Workers Holiday Makers Tax Scale i.e., ‘Workers Holiday Maker Scale’, ‘Workers Holiday Maker Scale - No TFN Supplied’ or ‘Workers Holiday Maker Scale - Unregistered Employer’ and the Worker Holiday Maker checkbox is not selected, the validation message will appear as shown in the figure below.

To save the Tax Scale as ‘Workers Holiday Maker Scale’, ‘Workers Holiday Maker Scale - No TFN Supplied’ or ‘Workers Holiday Maker Scale - Unregistered Employer’, it is mandatory to select Working Holiday Maker checkbox in the Obligations tab.

2. In the Applicant portal application, in case the user selects Tax Obligation Table as Workers Holiday Maker Scale, or Workers Holiday Maker Scale - Unregistered Employer, or Workers Holiday Maker Scale - No TFN Supplied, and the Working Holiday Maker checkbox is not selected, the validation message appears ‘Invalid Tax Scale selection. Please check the Working Holiday Maker option to save the selected Tax Scale’.

Select the Working Holiday Maker checkbox to save any of the WHM tax scales in the Finance page of the Applicant portal application.

3. In the Applicant portal application, in case the user selects a tax scale other than the Workers Holiday Maker Scales, and the Working Holiday Maker checkbox is selected, the validation message appears ‘Invalid Tax Scale selection. Please uncheck the Working Holiday Maker option to save the selected Tax Scale’.

Passport Country

In the Staff portal, the Passport Country in the Visa of an employee is selected using the drop-down field. In Passport Country, the user needs to select the required country from the drop-down.

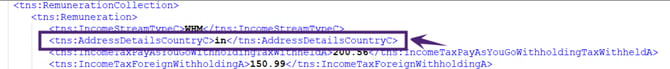

Country Code

The Country Code is reported for the home country of employees who are Inbound Assignees or Working Holiday Makers. For example, if you make a payment to an Australian resident working overseas or to a working holiday maker, you need to provide information about the host or home country.

The format for the Country Code is two-character alpha characters as per ISO 3166-1 alpha-2 international standards.

The Country Code is mandatory where the pay/update date is after 30/06/2020 and is not required to be reported for Australia and its territories.

PAYGW Amount

The PAYGW Amount reports the payments withheld for the employees and must be included separately as YTD amounts you have withheld from each income type. This is the YTD PAYGW Amount withheld from the gross amounts for the relevant income stream.

The PAYGW Amount Tuple is created after providing the amount withheld for the employee as shown in the figure below.

Lump Sum E Amount

For payments prior to 1 July 2025, lump sum E represents the amount for back payment of remuneration that accrued, or was payable, more than 12 months before the date of payment (Pay/Update Date) and was greater than or equal to the lump sum E threshold amount ($1,200).

From 1 July 2025, Lump Sum E (E) per financial year, the YTD annual threshold of $1,200 is removed, thus making the assessment and classification of each arrears payment that was payable more than 12 months prior to the date of payment easier to determine as lump sum E.

After 30 June 2025, if any prior FY amendments occur, the rules that applied pre-1 July 2025 to any lump sum E amounts reported remain. That is, if a finalised pay event for 30 June 2025 or earlier included lump sum E amounts and an amendment is performed to adjust any details, including the lump sum E amounts, the annual lump sum E $1,200 threshold rule applies. Similarly, if there was no lump sum E amount reported in a finalised pay event for 30 June 2025 or earlier and a prior FY amendment was performed to adjust any details, including the lump sum E amounts, the annual lump sum E $1,200 threshold rule applies.

You can report Lump Sum E through any of the processes outlined below:

- in each STP report, or

- only when you finalise reporting at the end of the financial year

When you report lump sum E payments, you will no longer need to issue employees with a lump sum E letter at the end of the financial year. This information will now be available on their income statement.

The following table outlines some examples of what should and should not be included in Lump Sum E.

|

Include |

Don't include |

For payments made prior to 1 July 2025:

For payments made post 1 July 2025:

|

|

Map all the LumpSum with the code type ‘E’ of Codes defined by ATO for Allowances/Deductions with Codes available in the System for Allowances/ Additions/ Deductions in the STP Allowance/ Addition/ Deduction Code Mapping screen as shown in the figure below.

The financial year value will be derived from the subtype value associated with the Lump Sum E tuple, from which the corresponding addition or allowance is mapped.

The Lump Sum E Tuple is created after providing the amount withheld for the employee as shown in the figure below.

For more details on the Lump Sum E amount, refer links below:

Overtime

The Overtime reports the YTD Overtime amount for the specific income type. The Overtime includes the work:

-

beyond their ordinary work hours

-

outside the agreed number of hours

-

outside the spread of ordinary hours (the times of the day ordinary hours can be worked)

The pay period amount of the Overtime is included in the Payer Total Gross Payments

Amount field.

The Overtime Tuple is created for the YTD Overtime for the employee as shown in the figure below.

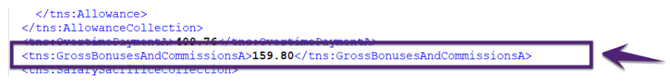

Bonuses and Commissions

The Bonuses and Commissions payments are paid to employees to reward their performance, service, or for meeting a specific goal. Only pre-sacrifice amounts that are classified as OTE should be included as bonuses and commissions.

Examples of Bonuses and Commissions include Christmas Bonuses, Retention Bonus, Sign-on Bonus for new employees, Performance Bonus, Referral Bonus, Bonus labeled as ex-gratia (in respect of ordinary hours worked), Return to Work Bonus after Paternal Leave or Commission Payment.

Map all the Bonuses and Commissions with the code type ‘BC’ of Codes defined by ATO for Allowances/Deductions with Codes available in the System for Allowances/ Additions/ Deductions in the STP Allowance Mapping screen as shown in the figure below.

The Bonuses and Commissions Tuple is created for the employee who received this amount as shown in the figure below.

Allowances

In STP Phase 2, all the Allowances and Additions are itemised separately, not just expense allowances that may have been deductible on the employee’s IITR. This means that allowances and additions that used to be reported as Gross for the income type must now be separately itemised in STP Phase 2 reporting.

As per ATO guidelines, reimbursement payments equal to the exact amount that reimburses an expense, verifiable by receipts, which was (or will be) incurred by the employee during their duties must not be reported.

ATO has defined mandatory obligations to report Child Support amounts through STP Phase 2, click to view the detailed information.

You must ensure the following points before processing the STP run:

-

In the Allowance master, all the allowances (except reimbursements) are already selected as Separately Itemise in STP.

While transitioning from STP Phase 1 to STP Phase 2, the Entire OnHire team will update the master settings of all the allowances and additions to be selected as ‘Separately Itemise in STP’, except reimbursements (if any provided by you), in the prerequisite document after STP Phase 2 rollout.

You need to review the settings of the allowances and additions in the master after the STP Phase 2 rollout.

-

In the Additions Deductions master, all additions are already selected as Separately Itemise in STP in the Additions and Deductions master screen as shown in the figure below.

The Allowances Tuple is created for the employee that shows the allowance type, and amount details as shown in the figure below.

Remap Allowances and Additions Codes with New Codes Defined by ATO

The STP Allowances and Additions codes will be remapped by the Entire OnHire team with the new codes defined according to ATO guidelines.

While transitioning from STP Phase 1 to STP Phase 2, all the existing Allowances and Additions codes will be remapped by the Entire OnHire team with the new codes defined according to ATO guidelines based on the data you shared in the prerequisites document.

You need to review the remapped Allowances and Additions codes after the STP Phase 2 rollout and ensure that the codes are set as per your requirement for a successful STP run.

To view the mapping of the STP Allowances/ Additions Codes for the STP:

- Click STP

→Allowances Mapping and the Single Touch Payroll Allowance Codes Mapping screen opens

-

The updated Allowances/ Additions/ Deduction codes provided by ATO are available in the Codes defined by ATO for Allowances/Deductions section and are already remapped with the Codes available in the System for Allowances/ Additions/ Deductions (based on mapping information provided by you)

-

You need to review the already mapped codes in the Codes available in the System for Allowances/ Additions/ Deductions section

![]() Click to view a reference guide for mapping common allowances/additions with ATO defined codes.

Click to view a reference guide for mapping common allowances/additions with ATO defined codes.

Refer to the Allowance type and corresponding Code/ Sub Type defined by ATO in the below table.

Note that for the Allowance type OD along with Code, Sub Type are also included.

|

Type |

Code |

Sub Type |

Description |

|

Allowance |

CD |

|

Cents per km allowance. This is the car expense allowance. |

|

Allowance |

MD |

|

Overtime meal allowance. |

|

Allowance |

TD |

|

Tool allowance. |

|

Allowance |

QN |

|

Qualification and certification allowance. |

|

Allowance |

KN |

|

Task allowance. |

|

Allowance |

OD |

G1 |

Other Allowance with Category as General for allowances such as Laundry allowance for the cost of laundering deductible conventional clothing. |

|

Allowance |

OD |

H1 |

Other allowance with Category as a home office for allowances such as home office equipment and the Internet. |

|

Allowance |

OD |

ND |

Other allowance with Category as non deductible for allowances such as private travel such as travel between home and work, payments for the cost of transport for private purposes. |

|

Allowance |

OD |

T1 |

Other allowance with Category as transport/fares for allowance payments, cost of transport for business related travel not traceable to a historical award in force on 29 October 1986. |

|

Allowance |

OD |

U1 |

Other allowances with Category as a uniform for allowances paid for the purchase of a uniform. |

|

Allowance |

OD |

V1 |

Other allowance with Category as a private vehicle for allowances such as cents per km payments for vehicles other than a car such as a motorbike or a van, |

|

Allowance |

BC |

|

Bonuses and Commissions (Do not map the bonuses or commissions that are paid in respect of overtime). |

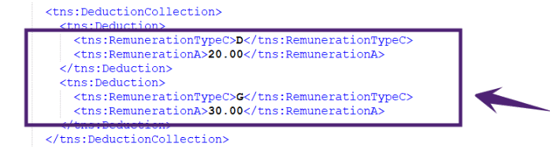

Deductions

STP Phase 2 introduces the ability to report the deductions for Child Support Garnishee/ Child Support Deduction and eliminates the need for employers to provide separate remittance advice to the Child Support Registrar while reporting through STP. However, you need to pay the required amounts directly to ATO by the date specified in your notice.

Employers cannot make a deduction of child support that leaves the employee with a net pay, after tax and child support deductions, of less than the Protected Earnings Amount (PEA). You also must report zero amount as Child Support deduction when processing the payrun for the employee, where you are unable to make child support withholdings due to insufficient wages of the employee.

Protected Earning Amount (PEA) is a legally prescribed value of post-tax net pay that must be paid to the employee from their salary or wages after their child support deduction has been withheld. It is indexed annually and updated by Services Australia on the 1st of January each year.

As the deduction notice specifies exact pay periods and amounts, if a child support deduction

amount cannot be fully withheld due to the Protected Earning Amount (PEA), any future retrospective amounts that apply to this pay period, must be taken into consideration to address the shortfall amount.

You need to evaluate and deduct the child support deduction amount in the Finance application taking into consideration the Protected Earning Amount (PEA) defined by the Child Support Registrar.

Refer to the Deduction type and their corresponding codes defined by ATO in the below table.

|

Type |

Code |

Description |

|

Deduction |

G |

Child Support Garnishee |

|

Deduction |

D |

Child Support Deduction |

ATO has defined mandatory obligations to report Child Support amounts through STP Phase 2, click to view the detailed information.

The Deduction Tuple is created for the employee that shows the deduction details as shown in the figure below.

Salary Sacrifice

The Salary Sacrifices Tuple in the employee file includes the 'S' or 'O' code in TypeC and the amount of salary sacrifices in PaymentA.

When selecting the Type as Deductions in the Addition and Deductions screen, you can choose either Salary Sacrifice to Superannuation or Salary Sacrifice for Other employee benefits option at a time.

The Salary Sacrifice for Other Employee benefits and Salary Sacrifice to Superannuation tuple is created as shown in the figure below and will be mapped as 'O' and 'S' respectively in the STP report.

For more details, click this link.

Superannuation

The Superannuation Tuple in the employee file includes the 'L' code in EntitlementTypeC and the amount of Guarantee Super in EmployerContributionsYearToDateA.

Only zero or positive amounts should be reported for the YTD amount.

ATO’s Position Papers for STP Expansion

The ATO has provided detailed information for Single Touch Payroll (STP) Phase 2 including various Position Papers. These Position Papers provide a detailed context with examples to help and implement STP Phase 2 efficiently.

For your quick reference, click the link to read the instructions provided in the STP Phase 2 Position Papers.

![]() Click to view the STP Phase 2 Transition Guide.

Click to view the STP Phase 2 Transition Guide.