Pay History (STSL/SFSS)

The Pay History (STSL/SFSS) report provides total figures of Study and Training Support Loans (STSL) and Student Financial Supplement Scheme (SFSS) repaid by members in the Selected year and/or Month.

Purpose

The Pay History (STSL/SFSS) report provides a record of payroll deductions related to Study and Training Support Loans (STSL) and Student Financial Supplement Scheme (SFSS).

It helps payroll and finance teams verify repayment amounts withheld from employee wages, as reported through Single Touch Payroll (STP).

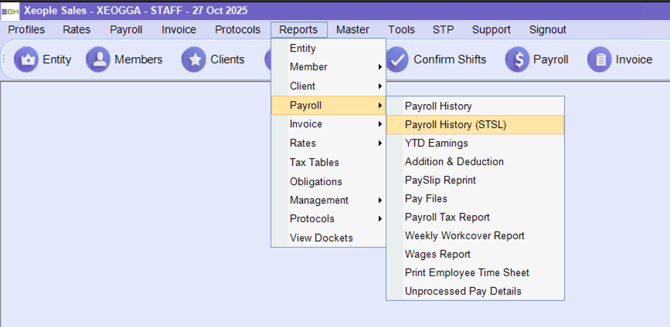

Navigation Path

Reports > Payroll > Pay History (STSL/SFSS)

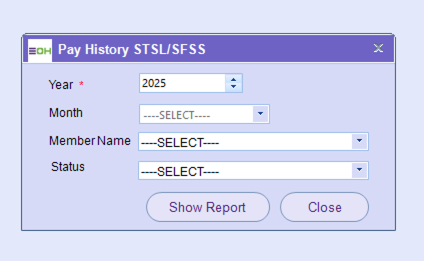

How to Generate the Report

-

From the top menu, select Reports → Payroll → Pay History (STSL/SFSS).

-

In the report window:

-

Year – Select the financial year you wish to view.

-

Month – (Optional) Filter by a specific month.

-

Member Name – (Optional) Choose an individual employee to narrow results.

-

Status – Filter by active or inactive employees.

-

-

Click Show Report to generate the results.

Report Output

Once generated, the report displays all employees with STSL or SFSS deductions for the selected period.

Columns include:

| Column | Description |

|---|---|

| Emp ID | Unique employee identifier within the system. |

| First Name / Last Name | Employee’s name as listed in payroll records. |

| STSL Amount | Total amount withheld for the Study and Training Support Loan for the selected period. |

| SFSS Amount | Total amount withheld for the Student Financial Supplement Scheme (if applicable). |

Example Output

| Emp ID | First Name | Last Name | STSL Amount | SFSS Amount |

|---|---|---|---|---|

| 67 | Dan | Kennedy | $34.00 | $0.00 |

| 32,851 | TQ-Chandler | Stevenson | $96.00 | $0.00 |

Total Records: 2

Use Case

-

Payroll Reconciliation: Ensures employee deductions match ATO reporting.

-

STP Validation: Confirms that study loan repayments are accurately transmitted via STP.

-

Employee Queries: Useful for verifying employee pay-slip deductions or end-of-year summaries.

Notes

-

This report is typically run monthly or quarterly for internal reconciliation.

-

Ensure payroll data is finalised before generating the report to maintain accuracy.

-

STSL and SFSS values will only appear for employees who have declared these repayment obligations via their TFN Declaration.