How to create/edit an Allowance

Allowances in Entire OnHire enable you to add additional payments beyond standard earnings for your Members, which can also be billed to clients as needed. Common examples include travel, certification, and uniform allowances, as well as different types of bonuses. With Entire OnHire, you have the flexibility to create custom allowances tailored to your business requirements.

To create an Allowance in Entire OnHire, follow these steps:

-

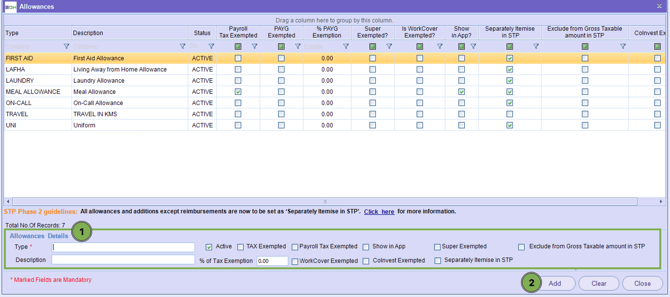

In the Finance Portal select: Master > Payroll > Allowances

-

To add a new Allowance, enter the relevant details in the fields provided at the bottom of the screen.

- Type: This is the code that appears on Payslip (Maximum of 10 Characters recommended).

- Description: Description field to define the allowance in addition to the Type.

- Active: Ensure the allowance is set to active. The status can be used to inactive unused allowances.

- TAX Exempted: If ticked, it will exclude this Allowance in the Members Tax liability calculations.

- Payroll Tax Exempted: If ticked, it means this Allowance is exempt from payroll tax.

- Show in App: If ticked, it will allow Members to view allowance via the App apart of Version X - Allowances and other details.

- Super Exempted: If ticked, it means the allowance is exempted from being included in super calculations.

- CoInvest Exempted: This setting is only required to be ticked if you are associated with CoInvest and require the allowance to be exempt from CoInvest obligations.

- % of Tax Exemption: This field is used if you are required to nominate a specific percentage of an allowance that is Tax Exempt.

- WorkCover Exempted: If ticked, the allowance will be exempt from WorkCover obligation calculations.

- Separate Itemise In STP: If selected, this option will display the allowance as a separate item in end-of-year reports submitted to the ATO.

- If you separate this, you’ll need to map using the allowance step code or you’ll be unable to submit your STP until it’s mapped.

- Exclude from Gross Payment Summary: If ticked, this will exclude the allowance from being included in Gross Payment Summary.

After entering the required settings, select Add to save the new allowance.

After adding the allowance, review all entered details carefully to confirm their accuracy.

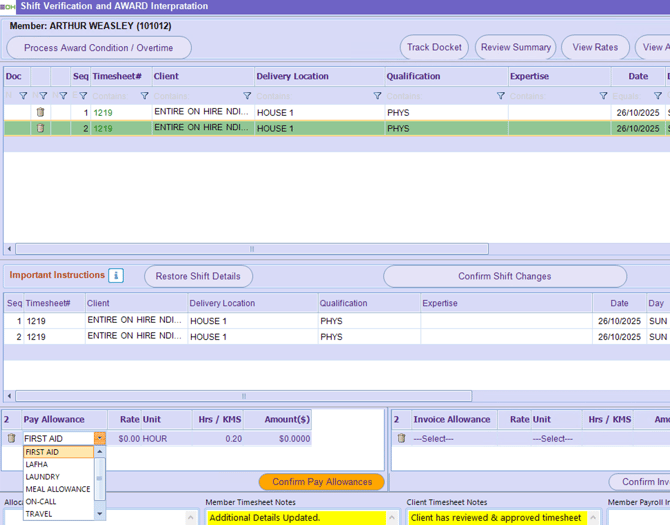

Once the allowance has been added, you can apply it within the shift validation screen to include it in the Member’s pay and, if needed, pass the charge on to the client.

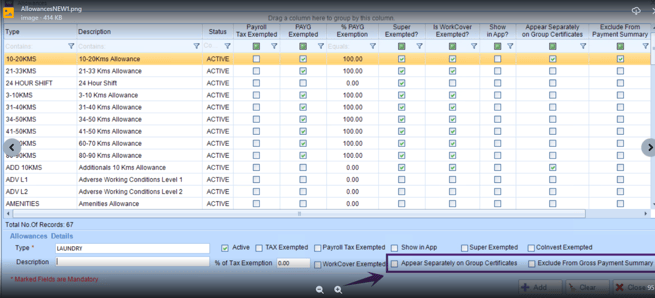

Update V8

In the Allowances screen, you can select either Appear Separately on Group Certificates or Exclude From Gross Payment Summary in the Allowances Details. Note that the STP Gross formula for the Employee File of STP Phase 2 deducts any one of the specified allowances at a time.

Example of Allowances