Finance - End Of Financial Year Processes 2023-2024

Please see below articles regarding the EOFY Process. We know this can be a stressful time of the year - so, hopefully you find the below articles easy to follow and can work your way through them. Otherwise, feel free to get in touch with the support team - we are eager to hear from you and assist you with getting your financial year closed off nicely. Here is a recording from our EOY Webinar from 2024 if you missed it!

Please also register for our upcoming webinars

Please register for EOFY Session 1 on Jun 13, 2024 2:00 PM AEST at:

https://attendee.gotowebinar.com/register/5999063422616339036

After registering, you will receive a confirmation email containing information about joining the webinar.

Please register for EOFY Session 2 on Jun 27, 2024 2:00 PM AEST at:

https://attendee.gotowebinar.com/register/4696524773748250967

After registering, you will receive a confirmation email containing information about joining the webinar.

Please download our Checklist to follow ![]()

Key Things to Remember:

-

Please Reconfirm your end of Financial Year dates and Super Cut off Dates before you start your end of year process.

-

Any Adjustments to Payslips need to be completed before your final STP is processed- Otherwise they HAVE TO be processed the following year. As you cannot return after you close of your STP.

-

Ensure your Terminated Employees have Termination date and Reason on their profile

Step 1 - Pre-Final Payroll and STP Submission Checklist

We recommend that you reconcile your payroll General Ledger accounts as of the end of May 2024. It is important that your Gross Wages, PAYG Tax and Superannuation accounts are all reconciled to your GL as of the end of May. Please also pay attention to any RESC ( Salary Sacrifice ) and allowances.

If you identify any variances in this step, please rectify these prior to running your final payroll for this financial year.

Remember, you can process a negative pay so, any adjustments required to employee gross earnings or tax can be done through a normal payroll run.

-

Ensure your allowances are set up correctly in line with the ATO requirements

-

Ensure all overpayments have been adjusted accordingly within reports

Next, confirm your STP submissions for the current financial year and ensure that they are all at completed status. If there are any not at completed status, please ensure these submissions are completed prior to processing your final STP for the financial year.

Finally, confirm the details of all your members - including elements like their TFN, super details, and proper STP settings/mappings (e.g. termination reasons, allowances, etc.). If you identify a significant mistake that you are unable to fix - feel free to get in touch with the support team as we will be able to investigate for you and provide a solution.

Step 2 - Running your Final Payroll And STP Submission

Prior to running your final payroll for the current financial year, we would recommend that you review the confirmed shifts area in finance and ensure that there are no outstanding shifts that require payment, invoicing or both.

Remember, you can discard the remaining half of any shifts that are at pay only or invoice only status by right-clicking on the timesheet number and selecting discard shift permanently. Please only do this if you are not going to process the remaining half of the shift.

Now you can move onto submitting your final payroll for the financial year:

Your final cut-off payroll is signified by the end of the financial year date that is set in your system. Once you have processed a pay run with this date as a week-ending date, you will not be able to process any further payrolls in the current financial year. Any payrolls processed with a week ending date post your current end of financial year date will be considered a new financial year payroll.

Before running this final cut-off of the payroll, please ensure all adjustments that are required have been included in this, or a previous, payroll.

Final Date that all pay runs need to be completed by is - 30 June 23

TIP: You are able to keep the Final EOFY STP open by having a pay year end date higher than the week ending date for final payroll week adjustment. People can do adjustments for 51 weeks but the week 52 you only get to know after the payroll run.

We recommend that you do not send your final STP immediately after the final cut-off payroll is processed. The final STP can be submitted at any time prior to changing your financial year dates.

Please ensure that your final STP is at completed status prior to changing your financial year dates.

It is recommended that you reconcile your final payroll with your final GL ( using the same procedure as above ) and ensure that you are completely happy that your final Payroll Summary and your General Ledger match. Remember, you would have reconciled to the end of May so you will only need to ensure that the month of June is correct. Once all is correct and you are satisfied that your payroll for FY23 is complete, go ahead and submit your final STP

For those of you who are using branches, please ensure that you do not submit a final STP for any branch until you are satisfied that all branches are complete and correct.

Please also ensure that your final STP for all branches are at completed status before proceeding to change your financial year and superannuation cut-off dates for any branches.

Before setting up your financial year, please finalise your payroll tax by reviewing the report

Step 3: Configuring the System for the New FY

At this stage, we are assuming that you have successfully and correctly completed your final payroll and STP submission for the 23-24 financial year. So, now we:

- Change payroll financial year dates

- Enter Superannuation cut-off dates

- [OPTIONAL] Update your pay and charge rates for the new financial year

To start a new financial year, you will need to set your start and end dates, as well as your new Superannuation, cut off dates.

Please note: All of the above must be done prior to processing any payroll in the new financial year

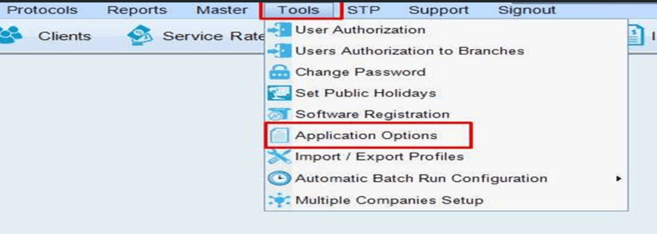

The change in payroll financial year dates is to be completed once you have finalised your final payroll run and submitted your final STP. To change the dates, you select Tools > Application Options

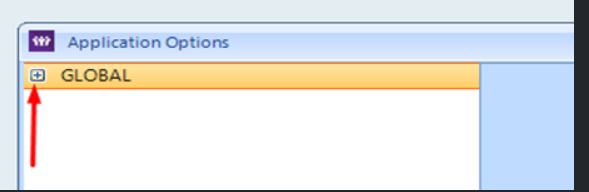

In the next screen, select the the + sign to expand the menu under Global

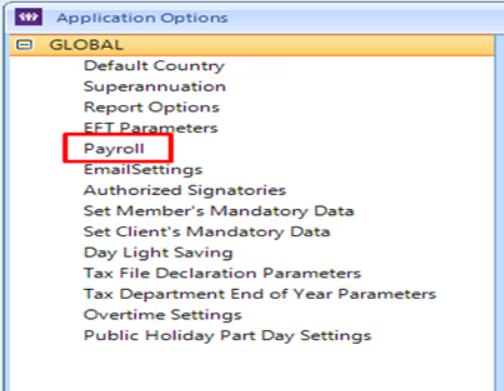

Once the menu has been expanded, select Payroll

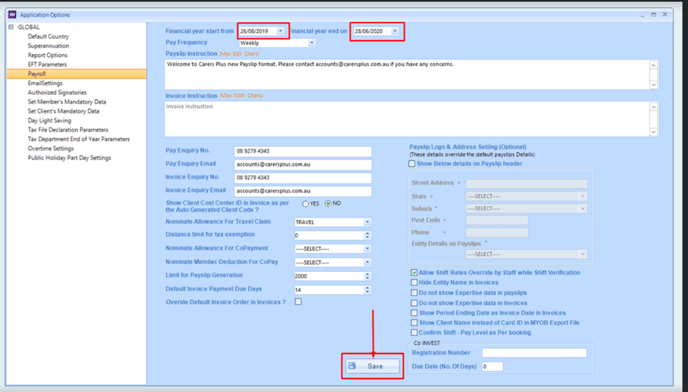

Once Payroll has been selected, you will see your current payroll financial year dates displayed.

To change these dates, you overwrite the current dates with your new dates and select Save ( located at the bottom of the screen ). This completes the reset of your payroll financial year.

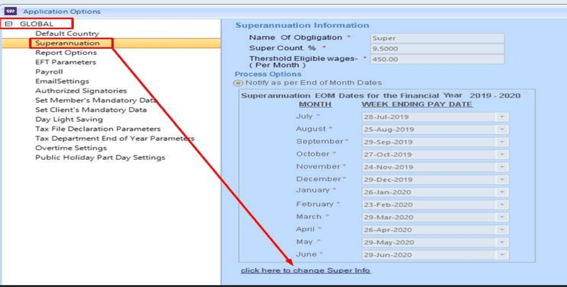

Once you have entered your new financial year dates, superannuation cut off dates need to be set to complete the rollover to a new payroll financial year. To set these dates, in your finance environment, go to Tools > Application Options

In the next screen, expand the + next to the word Global and then select Superannuation. You will then need to select click here to change Super Info

The next screen will then refresh and enable you to enter the cut off dates for each month in the new financial year.

1. Click Clear

2. Once you have entered the correct week ending pay date for each month, you will need to select update to save them. Please ensure your cut off date reflects the last Sunday (week ending date) that you will process and pay within the same month.

If desired, you can now update your pay and charge rates for the new financial year - following the instructions on this knowledge base: How to Change Payrates for the New FY.